Are you lacking from the complete information of GSTR 7 return?

This article will let you know every term of GSTR 7 in the simplest way.

All your doubts and myths will be cleared in this post.

Contents

What is GSTR 7 Return?

GSTR 7 is a monthly return form under the GST, which should be filed for tax deducted at source (TDS) by the tax deductor. GSTR-7 contains all the required information like details of TDS amount, debit entries for TDS, TDS liability, refund claimed if any etc.

GSTR-7 Eligibility i.e Who needs to deduct TDS?

The GSTR 7 form is filed by any registered taxpayer who deducts tax according to TDS provision – under section 37 of GST Act, which is about furnishing the details of outward supplies.

As per section 37 under GST Law:

Following person are required to levy TDS–

a. A department or organization of the Central or State Govt.

b. Local Authority or jurisdiction

c. Government Agencies

d. Persons or category of particular persons as may be notified on the suggestions of the council by the state or central government.

Recommended: TDS Certificate – Know Everything About GSTR 7A Under GST Return

Following establishment are required to deduct TDS under GST–

a. Any setup made by the parliament or the Government, with 51 percent authority owned by the Govt.

b. A society established by any Govt or local authority

c. Public sector undertaking in India.

TDS has to be deducted if the total value of supply under contract exceeds RS. 2.5 Lakh. 2% all TDS rate levied on intra and interstate supplies differently.

Features of GSTR 7

- GSTR 7 contains all the details of tax deducted at source.

- It is filed by only specific taxpayers given above.

- TDS is deducted while making payments to the suppliers by particularly registered taxpayers.

- It is filed monthly by 10th of the subsequent month.

Due Date for Filing GSTR 7

GSTR 7 return should be filed monthly by 10th of the next month for proceeding tax period.

Note: Revised GSTR 7 due date for filing-

- October 2018 to July 2019 –

31st August 2019[ Due Date Extended by CBIC ] - August 2019 –

10th September 2019 - September 2019 –

10th October 2019 - October 2019 –

10th November 2019 November 2019 – 10th December 2019- December 2019 –

10th January 2020 - January 2020 – 10th February 2020*

Also Read: TDS Mechanism under GST in PDF

Late fee or Penalty if you Don’t File GSTR 7 on Time

The amount of late fee payable by the specific taxpayer will be Rs. 200 per day (Rs. 100/- per day each under CGST & SGST Acts). Along with the penalty, 18% interest per annum on the tax to be paid.

Note: There is no penalty on IGST for delaying GSTR 7.

How to Revise GSTR-7 Form if any Mistake Done

GSTR 7 cannot be revised once filed in that month, however, any mistake made by tax deductor while filing GSTR 7 form can be revised in the next month’s return.

Format and Procedure for Filing GSTR 7

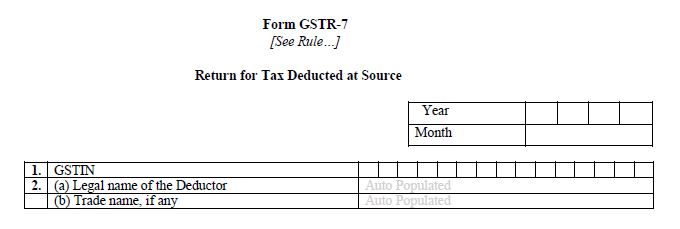

Table 1 and 2: It contains GSTIN number, legal name deductor and trade name if any

GSTIN: Unique GST identification number assigned to each registered taxpayer under GST

Legal Name: Name of the specific registered taxpayer for TDS

Trade Name: Name of the business, if any

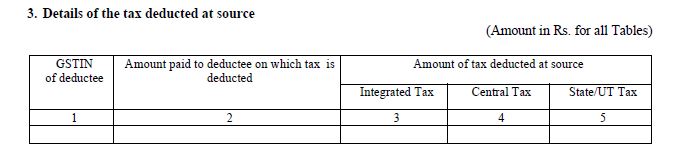

Table 3: This part is for all the details of the tax deducted at the source which contains GSTIN of deductee, the total amount paid and TDS amount (integrated/central/state tax) differently.

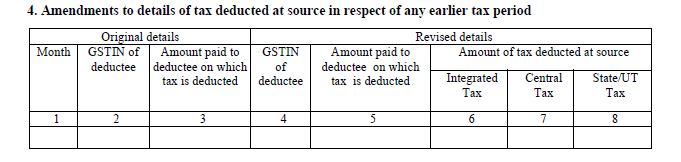

Table 4: Amendments/changes to details of tax deducted at source in respect of any earlier tax period

This table contains the original and revised details of previously supplied TDS.

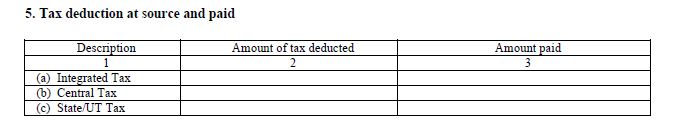

Table 5: Tax deduction at source and paid

In this section, you need to furnish the details of tax (integrated/central/state) amount deducted from the deductee and the tax (integrated/central/state) the amount paid.

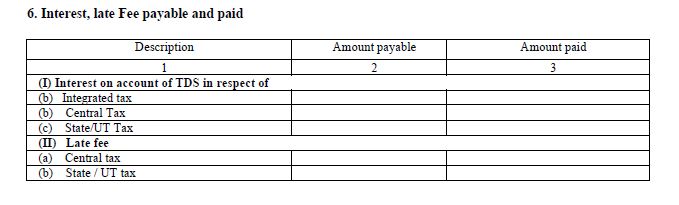

Table 6: Interest, Penalty payable and paid

It contains the details of such interest on account of TDS and late fees payable along with the amount paid.

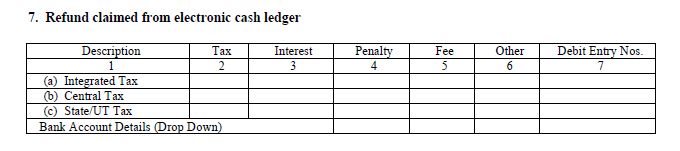

Table 7: Refund claimed from electronic cash ledger

It provides the details of any refund claimed from your electronic cash ledger on the payment of TDS.

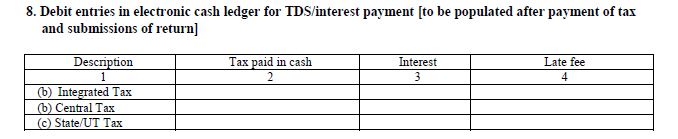

Table 8: Debit entries in electronic cash ledger for TDS/interest payment [to be populated after payment of tax and submissions of return]

Once all the entities are filled, the last step will be the declaration regarding the correctness of the information given in above format with a digital signature.

When you finish filing the GSTR 7 return and make payments, the details can be seen in your electronic cash ledger.

How to Start GSTR 7 filling

Please read the post, complete procedure for filing GSTR-7 is given in this article.