E-commerce sellers or Online shopping sites like Flipkart and Amazon are also under the compliance of GST, that means they are required to file regular returns and pay taxes in GST. You can find here the details of the GST Return forms, the process of return filing, due dates, applicability, etc. for e-commerce sellers.

The following two types of entities are treated as e-commerce sellers:

- E-commerce marketplace operator: The website or e-commerce platform (and its owner) where the transactions take place.

- E-commerce marketplace suppliers: The businesses/people who sell goods & services through these e-commerce sites, like Amazon sellers.

GST Return Forms for E-commerce Operators and Suppliers

The Flipkart sellers, Amazon sellers, and the sellers and operators of other online shopping platforms are required to file the following returns under GST.

GSTR-1 -> Details of outward supplies (sales) – To be filed by 11th of the next month for a tax period

GSTR-2 -> Details of inward supplies (purchases) and ITC claimed on it – 15th of the next month

GSTR-3 -> Monthly return along with payment of Tax – 20th of the next month

GSTR-8 -> To be filed by the e-commerce operator mentioning the details of supplies processed and the amount of tax (TCS) collected – 10th of the next month

GSTR-9 -> Annual GST Return – to be filed by 31st December of the next financial year

GSTR Returns Filing Process for E-commerce Sellers

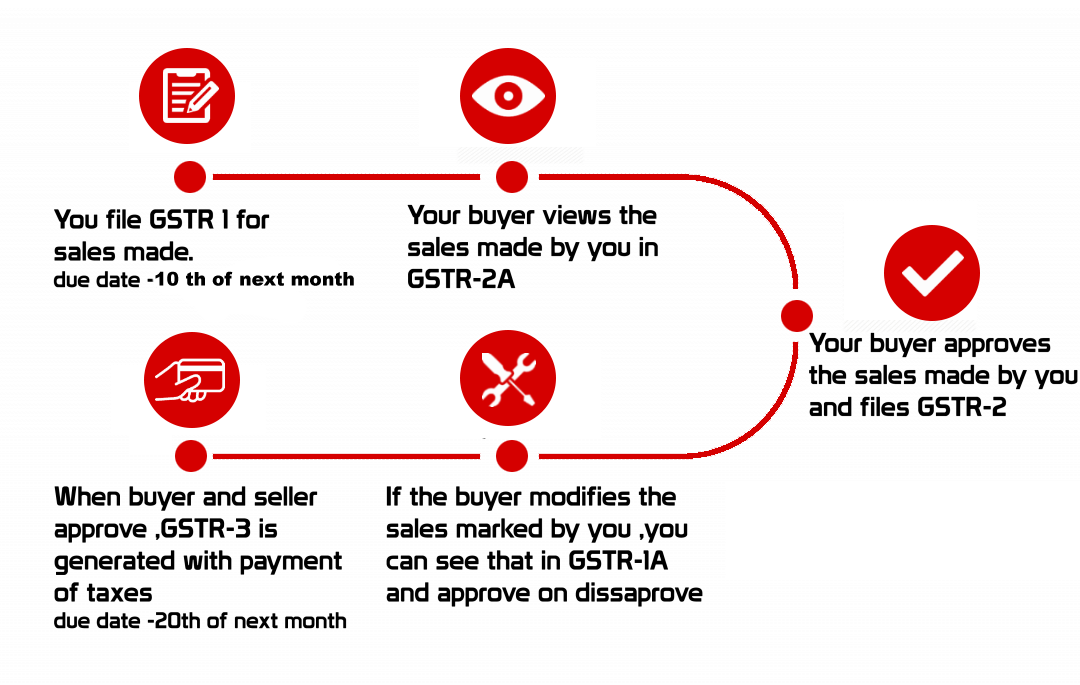

The following process takes place for ecommerce operators and suppliers to file their GST returns.

1. The seller files the GSTR-1 Form furnishing the details of the outward supplies made by him in a particular month, by 10th of the next month.

Note: The information filed by a seller in his GSTR-1 form will be available to the respective buyer in his GSTR-2A form, which he can approve or modify to file his own GSTR-2 Form.

2. Then, the seller files the GSTR-2 Form to provide the details of the purchases (rough material, resources, etc.) made by him in that particular month to claim ITC, by 15th of the next month.

3. The seller files the monthly return Form GSTR-3 by 20th of the next month providing the details of tax and makes the payment.

4. The e-commerce operator files GSTR-8 Form by 10th of the next month to furnish the details of the supplies processed and TCS collected by them.

5. The annual return Form GSTR-9 is filed by both the supplier and the operator by 31st December of the next financial year.

Download Revised GST Return Rules in PDF

Let’s simplify this with an example:

GSTR return filing for Amazon sellers and Amazon marketplace

Suppose that Anuj is a seller of electronics goods on Amazon India. He sells 20 items through Amazon store in the month of July 2017. Then, he will file GSTR-1 Form providing the details of the supplies made by him in the month.

These details will be, in turn, available to Anuj’s buyer (say Krishna) in Form GSTR-2A. Krishna will verify the details and file his GSTR-2 accordingly.

If he makes any modifications in the details in GSTR-2, it will be visible to Anuj through Form GSTR-1A for his approval. The details furnished by the seller and that of the buyer must be accurate and same.

Important Notes

-> The GST system has specific rules for accepting the details of supplies, matching the details provided by the e-commerce operator with that of the suppliers, and rectifying the discrepancy in details.

-> If there is a discrepancy in the details which is not corrected even after the notice, the supplier will have to pay the amount equal to the difference and an interest along with his output tax of the succeeding month.

-> There is a penalty of Rs. 100 per day (up to a max of Rs. 5,000) on late filing of GST Returns.

-> E-commerce suppliers will have to file Form GSTR-1, 2, 3 on monthly basis and GSTR-9 on annual basis.

-> E-commerce operators will file all the above forms. In addition, they will also file GSTR-8 Form and pay TCS to the government by 10th of the next month.

-> An e-commerce platform seller who also sells goods/services offline will have to mention the details in the respective columns of the GSTR-1 Form.

TCS for E-commerce Sellers

Amazon, Flipkart and all other online marketplaces are required to collect tax at source (TCS), which is fixed at 1% of the value of supplies, when making payments to sellers on these portals. It will be levied by the operator and passed to the government. TCS is applicable only when the operator has received the payment from the customer and is paying to the seller. It is not applicable to the payments received by a seller directly from the customer.

I am small seller of an ecommerce platform. I am not registered in gst. If now I apply to registration in gst then how can I file gstr for last 2 months like July August. Please reply