All the businesses registered under GST are given a unique identification number known as GST Identification Number or GSTIN. It is same as the TIN number provided to businesses under the state VAT system or the service tax registration number assigned by the CBEC.

Since all these taxpayers will be registered under a single platform in GST, it is convenient to assign them unique ID numbers for identification purpose. The government has established the GST Network (GSTN) to provide the proper IT infrastructure to manage the return filing and other digital operations of the new tax system. Many people are still not fully aware of the GST registration process and about GSTIN.

Contents

The Role of GSTIN

As we mentioned earlier, GSTIN is the unique GST identification number assigned to each registered taxpayer under GST. This number will be used to identify you as a registered taxpayer. It makes you eligible to perform various tax operations like return filing, refund claim on GST Portal, collecting tax from your customers and more.

How Does GSTIN Look Like?

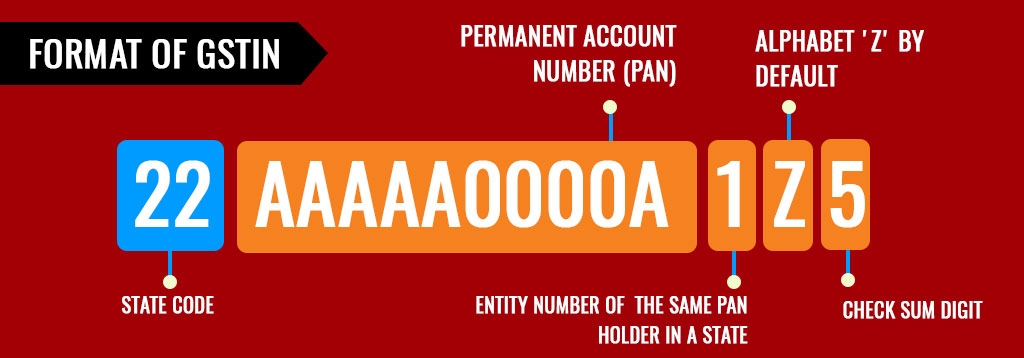

GST Identification Number is a state-wise 15-digit PAN-based number unique for each taxpayer.

Here’s the complete break-up of GSTIN:

- The first two digits of GSTIN represent the state code for the particular taxpayer as per Indian Census 2011. Each state is given a unique two digit code under GST.

- The next 10-digits will be the PAN number of the taxpayer.

- The next digit (thirteenth digit) indicates the entity number of registration of a business (taxpayer) within a state for the same PAN.

- The fourteenth digit will be always a ‘Z’.

- The last digit will be a check code used to detect errors. It may be a number or an alphabet.

Users need not do anything special or know anything specific about their GSTIN number. Just know that it is crucial to register under GST as a taxpayer, and GSTIN is the number that identifies you as a registered GST taxpayer.

Provision GSTIN Validity

GST is compulsory for new taxpayers as well as for existing taxpayers who are already registered under State VAT or Central Excise or Service Tax. However, the existing taxpayers with CBDT validation need not apply for fresh registration under GST. They can apply for a provision GSTIN which will be valid for 6 months.

How to apply for GSTIN?

Meanwhile, they can provide necessary data for GST registration form, after which their provisional registration will automatically convert into normal registration. The service taxpayers with centralized registration, though, are required to apply for a new GST registration from their respective states.

The processing and complete IT infrastructure of the GST system will be managed by the Goods and Service Tax Network (GSTN). This is the official portal for taxpayers to register in GST, file taxes, etc. It is also used by the government to keep the record of every tax transaction.

How To Verify GST Number Online And Find Fake One

GST number verification online is possible with the GSTN portal. First of all, on the receipt, check the GST Identification Number. If you are purchasing a product and dealer is charging GST, and there is no mentioning of GSTIN, then this case will be considered under an illegal transaction. Previously, GSTIN was VAT TIN number or service tax registration number and now it is compulsory to put the GSTIN on the invoice.

Process To Verify The GST Identification Number:

- Go for GST Portal official website at www.gst.gov.in

- Click on the option provided in menu bar mentioning “Search Taxpayer”

- In the search field, enter GST Identification Number

- If the entered GST Identification Number is right, then only you can see the following details regarding the supplier or dealer:

- Legal name of the business

- Date of registration

- Constitution of business

- GSTIN / UIN Status

- Taxpayer Type

5. In case the GST Identification Number is not right, then you will come across with an error message. If you encounter with this situation, contact the vendor and ask about the correct GSTIN.

What If GSTIN is Fake?

Using fake GSTIN is an offense and it covers following illegal activities:

- Supplying without providing invoice or with a fake and wrong invoice

- Fail to register instead of already accountable to be registered

- Issuing document or invoice with another person’s GSTIN

Recommended: What is GST Fraud and How You Should Deal with it?

Penalties For Using Fake Invoice:

For the fake invoice cases or offense, the maximum liable penalty is 100% of the tax avoided or maximum Rs. 10,000, whichever among the two is higher will be considered. If any person helps in acting these offenses, then the penalty can go high up to Rs 25,000 as well.

Table Of Prosecution:

| S.N. | Tax Avoided | Punishment In Term Of Imprisonment |

| 1. | 100 to 200 Lakhs | Upto 1 year along with applicable fine |

| 2. | 200 to 500 Lakhs | Upto 3 year along with applicable fine |

| 3. | More Than 500 Lakhs | Upto 5 year along with applicable fine |

Process To Complain For Fake GSTIN:

If you have any problem regarding GST or you want to complain about the fake GSTIN, you can freely contact to the provided phone numbers and email addresses. Here they are:

- Register the Complaint at https://selfservice.gstsystem.in/ or mail at helpdesk@gst.gov.in

- 011-23370115 or 0124-4688999 or 0120-4888999 are the helpline number