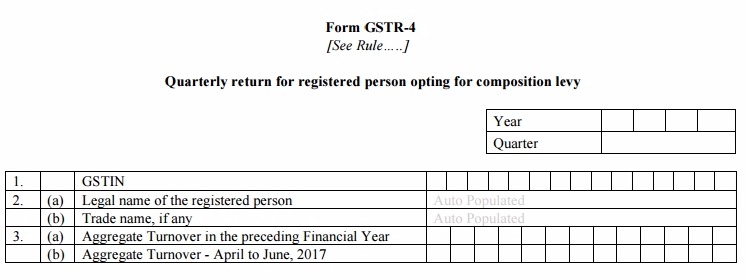

All registered persons who opt for composition levy under GST need to file quarterly return information using GSTR-4 between 11th and 18th of the month following the relevant quarter.

In our previous articles, we have discussed the process of filing GSTR-1 for outward supplies, GSTR-2 for inward supplies, and GSTR-3 for monthly tax returns. Here, we will discuss the procedure of filing quarterly returns on GST portal through GSTR-4.

Contents

Key Changes in GSTR-4 Return Form

Recently the authorities had announced major changes in the GST return filing process for the GSTR 4 form under GST. Those changes are:

- Now the taxpayers can create and submit GST returns online

- Simplified features introduced in association with the GSTR 3B form

- GST return filing process eased through the question

- Nil GST return filing now simplified

- Return filing procedure converted in objective type

To ease the process of return filing and GST registration, the government has introduced a GST composition scheme under which a registered business needs to file only one return per quarter, instead of the monthly returns. Check your GSTR 4 Last Date from in this table:

Due Dates for Filing GSTR-4

| Revised GSTR-4 Due Dates in India | ||

| Return Period | Due Dates | Details |

| April to June 2019 | Quarterly return for compounding taxable person. | |

| July to September 2019 | Quarterly return for compounding taxable person. | |

| October to December 2019 | Quarterly return for compounding taxable person. | |

| January to March 2020 | 18th April 2020* | Quarterly return for compounding taxable person. |

Note: From October 2017, the late fee payable by a taxpayer whose tax liability for that month was ‘NIL’ will be Rs. 20/- per day (Rs. 10/- per day each under CGST & SGST Acts) instead of Rs. 200/- per day (Rs. 100/- per day each under CGST & SGST Acts).

Download GSTR-4 Form Format in PDF

Who Can file GSTR 4 Form

All the taxpayers who have opted composition scheme under GST system have required to file GSTR-4 return:

- Suppliers of OIDAR (Online Information and Database Access or Retrieval)

- Composition Dealers

- Non-Resident Taxable Person

- Input Service Distributor

- Taxpayers liable to deduct (TDS)

- Taxpayers Liable to Collect (TCS)

- Compounding Taxable Person

How to File Online GSTR 4?

There are total 13 tables in GSTR-4, most of which will be auto-populated based on the existing information.

Table 1 will include the 15-digit Goods and Services Taxpayer Identification Number (GSTIN) of the particular taxpayer.

Table 2 will have the legal name of the registered person and trade name, if any.

Table 3: This information is required to be entered only in the first year.

(a) The taxpayer has to enter his/her aggregate turnover for the immediately preceding financial year. (b) Aggregate turnover of the taxpayer in the

quarter of the current financial year.

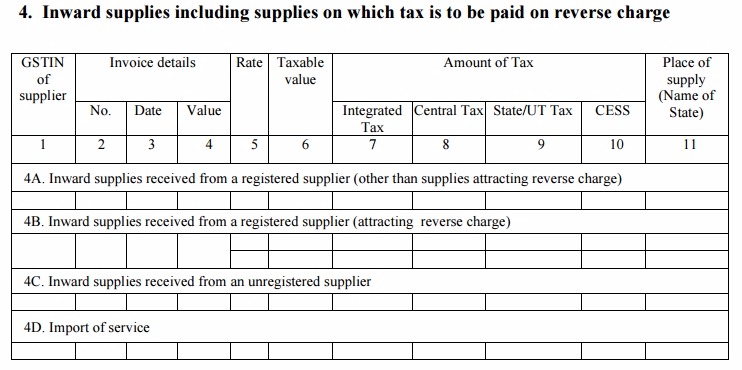

Table 4 will include the information of inward supplies. Most of the details will be auto-filled based on GSTR-1 of the supplier.

Table 4A will have information of inward supplies from registered suppliers (other than reverse charge supplies).

Table 4B to have details of all inward supplies from registered suppliers and attracting the reverse charge.

Table 4C will contain details of inward supplies from unregistered suppliers.

Table 4D details of Import of service

Place of Supply (PoS) to be entered only if it is different from the recipient’s location.

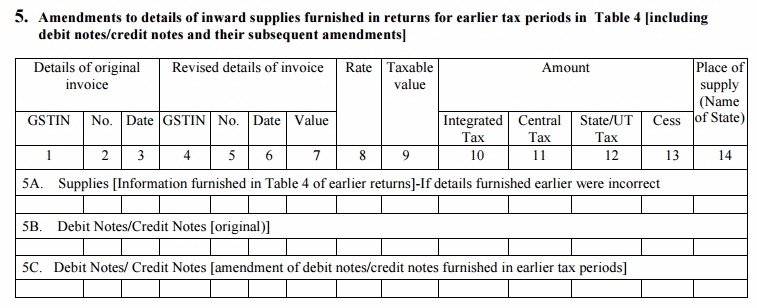

Table 5: It will capture the amendments of inward supply details provided in earlier tax periods, including the rate-wise original/ amendments of debit/credit notes received.

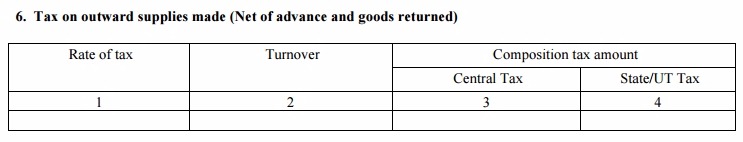

Table 6 will include the details of tax on outward supplies including advance and goods returned during the relevant tax period.

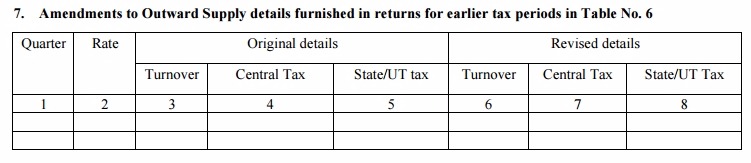

Table 7 to include details of the amendments to outward Supply details provided in Table No. 6 for earlier tax returns.

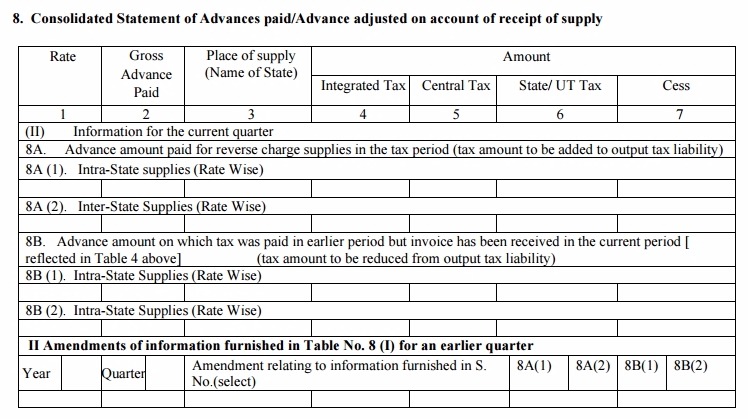

Table 8 Information of advance paid pertaining to reverse charge supplies and the tax paid on it including adjustments against invoices issued to be reported in Table 8.

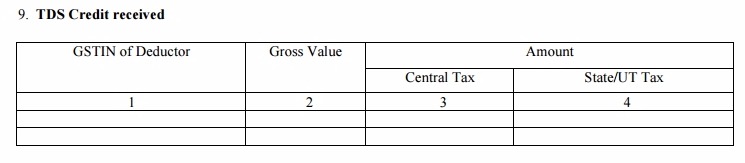

Table 9 Information of TDS Credit received would auto-populate from GSTR-7A Form.

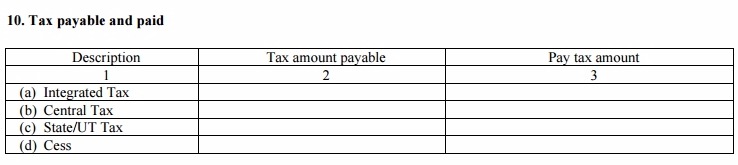

Table 10 The details of net tax payable and being paid here.

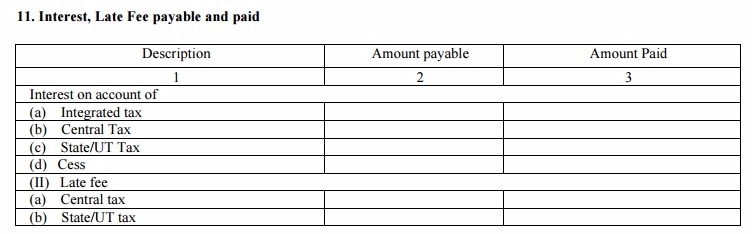

Table 11 will contain the information of any Interest and Late Fee payable and being paid here.

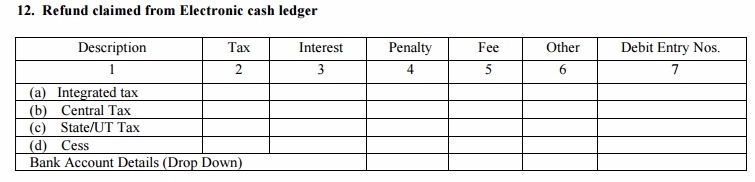

Table 12 Details of the refund amount claimed from Electronic cash ledger, and the bank account details.

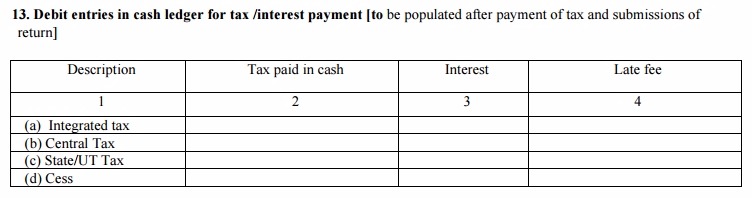

Table 13 Details of the debit entries made in cash ledger for tax /interest payment. It will auto populate after payment of tax and submissions of return.

Once the information is filled in all the tables, the taxpayer is required to digitally sign at the bottom to verify the information provided.

Note:

- GST composition scheme is mainly for small businesses.

- The registered person will pay taxes at a fixed rate.

- There is no provision of input tax credits under the composition scheme.

Useful Terms

- GSTIN: Goods and Services Tax Identification Number

- TDS: Tax Deducted at Source

Feel free to ask your GSTR-4 related queries in our free GST Help Desk App.