The Goods & Services Tax Return 5 (GSTR-5) form is to be used by registered non-resident persons to file monthly tax returns on GST portal. Each non-resident taxpayer, who carries out business in the country, is required to furnish GSTR-5 form details on or before 20th of the next month for a particular tax period.

| Last Dates of GSTR-5 Return | |

| Regular GSTR-5 Due Date | GSTR-5 Due Date for January 2020 |

| 20th of Next Month | 20th February 2020* |

Note: From October 2017, the late fee payable by a taxpayer whose tax liability for that month was‘NIL’ will be Rs. 20/- per day (Rs. 10/- per day each under CGST & SGST Acts) instead of Rs.200/- per day (Rs. 100/- per day each under CGST & SGST Acts).

This form can be filed online or by a Facilitation Centre. It will include the details of all inward and outward supplies performed by the particular non-resident during the tax period.

Due Date for GSTR 5 and GSTR 5A: GSTR 5 (Non-resident taxable person) and GSTR-5A (OIDAR) due date for January 2020 is 20th February 2020.

GSTR-5 is applicable in the following conditions:

You should be a non-resident foreign taxpayer with no business establishment in India.

You need to temporarily register under GST for as long as you wish to do business transactions in India.

You Can Also Read About How to File GSTR-1, GSTR-2, GSTR-3, GSTR-4 on GST Portal

How to file GSTR-5 Form?

There are total 14 tables in GSTR5 which is to be filled as below.

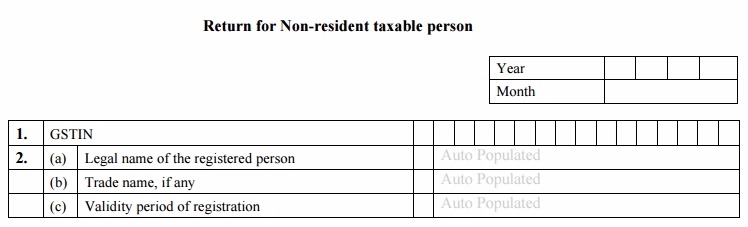

Table 1 & 2: Enter your 15-digit Goods and Services Taxpayer

Identification Number (GSTIN) in the first row. Enter your (taxpayer’s) name, trade name (if any), and validity period of registration.

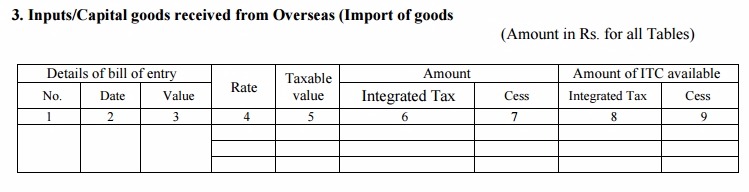

Table 3: Inputs/Capital goods received from Overseas (Import of goods)

The table is to contain the details of import of goods from outside of India, along with the bill of entry, tax amount, and the amount of ITC eligible on such imports.

The table is to contain the details of import of goods from outside of India, along with the bill of entry, tax amount, and the amount of ITC eligible on such imports.

The recipient person is required to provide the bill of entry details including six-digits port code and seven-digits bill of entry number.

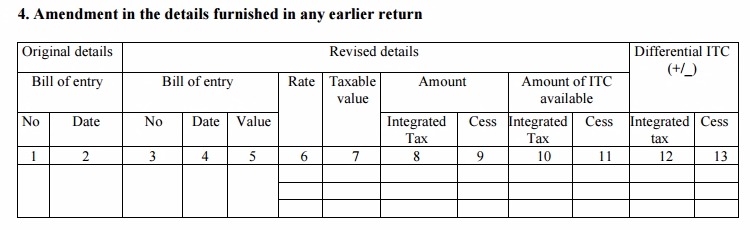

Table 4: Amendment in the details furnished in any earlier return

It will consist of amendment of imports already declared in earlier tax returns.

It will consist of amendment of imports already declared in earlier tax returns.

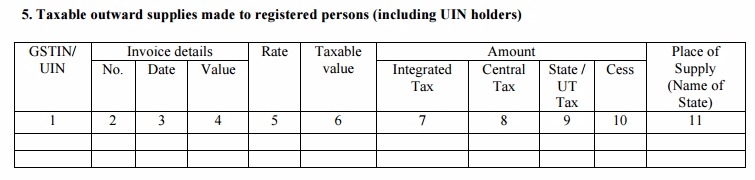

Table 5: Taxable outward supplies made to registered persons (including UIN holders)

This table will have the rate-wise, invoice-level information for all B2B supplies (whether inter-State or intra-State), for that tax period.

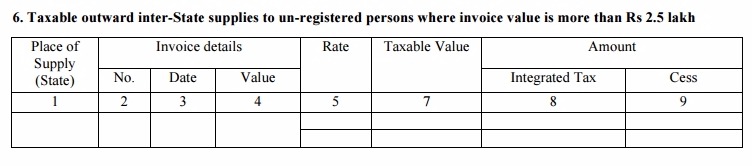

Table 6: Taxable outward inter-State supplies to unregistered persons where invoice value is more than Rs 2.5 lakh.

This will contain the Invoice-level details for all interstate B to C supplies, where invoice value is more than Rs. 2,50,000/- (B to C Large).

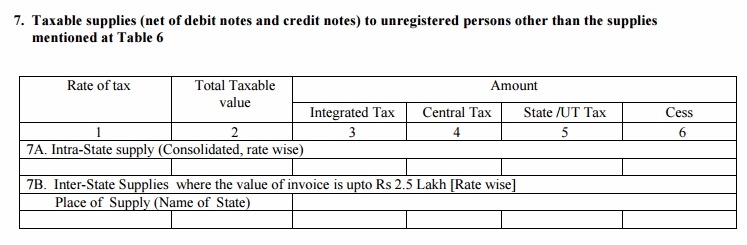

Table 7: Taxable supplies (net of debit notes and credit notes) to unregistered persons other than the supplies mentioned at Table 6.

This table will include the state-wise Invoice-level information for all B to C supplies (whether inter-State or intra-State) where invoice value is up to Rs. 2,50,000/-

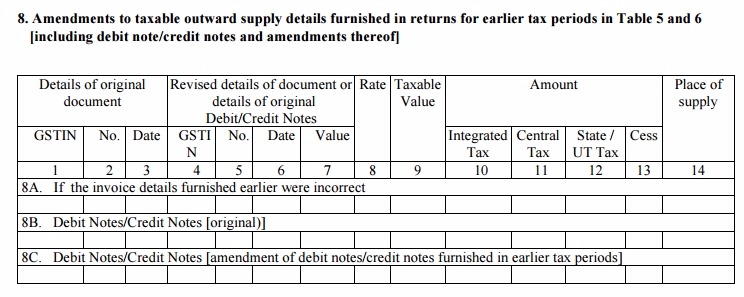

Table 8: Amendments to taxable outward supply details furnished in returns for earlier tax periods in Table 5 and 6 [including debit note/credit notes and amendments there of

This will consist of amendment details of the following:

- All B2B outward supplies reported in earlier tax period.

- B2C inter-State invoices where invoice value is more than 2.5 lakhs, reported in the previous tax period.

- Original Debit and credit note details and its amendments.

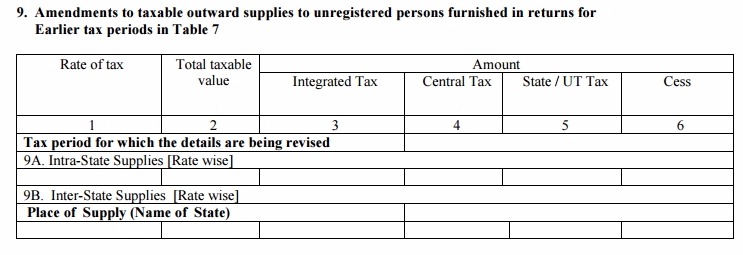

Table 9: Amendments to taxable outward supplies to unregistered persons furnished in returns for Earlier tax periods in Table 7.

This table contains details of Amendments for B2C outward supplies, excluding interstate supplies, with invoice value more than 2.5 lakhs.

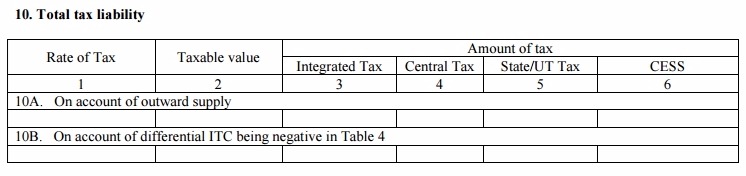

Table 10: Total tax liability

It contains the information of the total liable tax for outward supplies made in the current tax period and negative ITC for an amendment to imports made in the current tax period.

It contains the information of the total liable tax for outward supplies made in the current tax period and negative ITC for an amendment to imports made in the current tax period.

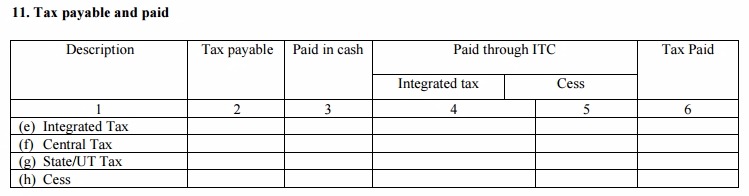

Table 11: Tax payable and paid

The details of tax (IGST, CGST and SGST) payable, tax paid through credit, tax paid in cash, and total tax paid.

The details of tax (IGST, CGST and SGST) payable, tax paid through credit, tax paid in cash, and total tax paid.

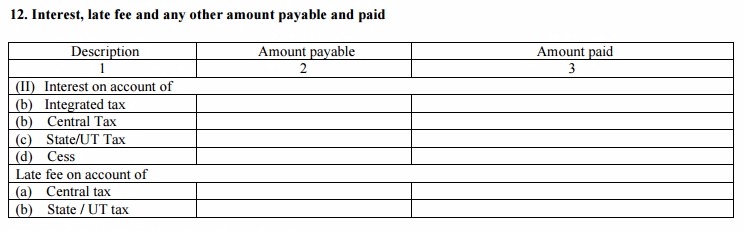

Table 12: Interest, late fee and any other amounts payable and paid

Details of the interest amount, late fee, integrated tax, Cess, and other amounts payable or paid.

Details of the interest amount, late fee, integrated tax, Cess, and other amounts payable or paid.

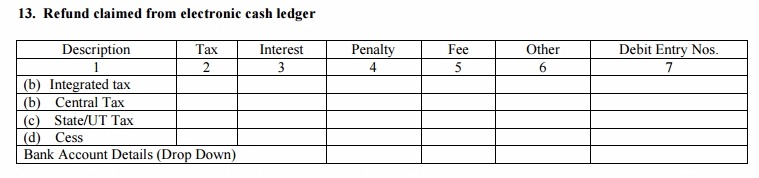

Table 13: Refund claimed from electronic cash ledger

Details of refund claimed from the cash ledger for the payment of tax.

Details of refund claimed from the cash ledger for the payment of tax.

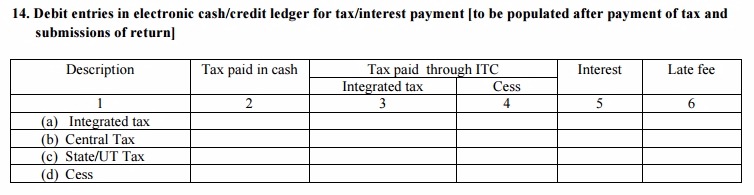

Table 14: Debit entries in electronic cash/credit ledger for tax/interest payment [to be populated after payment of tax and submissions of return]

Details of automatic debit entries made in cash ledger and credit ledger after successful payment of tax and interest. On submission of the tax return through GSTR-5, the system will automatically update ITC information in the respective ledgers.

The taxpayer has to digitally sign at the bottom of GSTR-5 confirming the validity of the information provided in the form.

Download All GSTR Form Formats included GSTR 5 and GSTR 5A

Feel free to ask your GSTR-2 related queries in our free GST Helpline Application.