All the registered taxpayers are required to make the payment of their taxes on GST Portal latest by the 20th day of next month for a particular tax period.

Taxpayers registered under composition scheme will have to pay GST only once every quarter, latest by 18th day of next month of a particular quarter.

Contents

GST Payment Due Date for General & Composition Scheme Taxpayers

- GST Tax Payment due date (normal taxpayer): 20th Day of the Next Month

- GST Tax Payment due date (composition scheme taxpayer): 18th Day of the Next Month of Quarter

Payment of Tax under GST

There is the provision of three different accounts (ledgers) for every registered taxpayer to make and maintain GST payments.

- Electronic Liability Register

- Electronic Cash Ledger

- Electronic Credit Ledger

Each of these ledgers holds different kinds of information and have different use during the GST payment process.

GST Payment Process

The GST Council has specified 7 forms for different processes under GST payment processing. These are explained below.

GST PAYMENT CHALLAN FORMATS AND RULES 2017

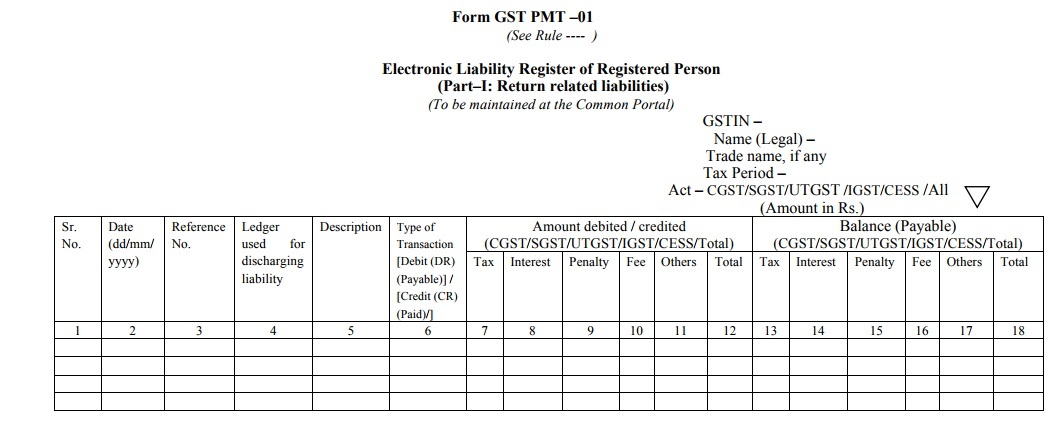

Form GST PMT-01

The electronic liability register is maintained using this form. This will contain the information of tax, interest, penalty, late fee, etc. a registered taxpayer is liable to pay on the Common Portal. The taxes and any other amounts paid by the taxpayer will be debited to this register.

The payment of the liabilities of a registered person shall be made from the electronic cash ledger or the electronic credit ledger and the amount will be credited to the electronic liability register.

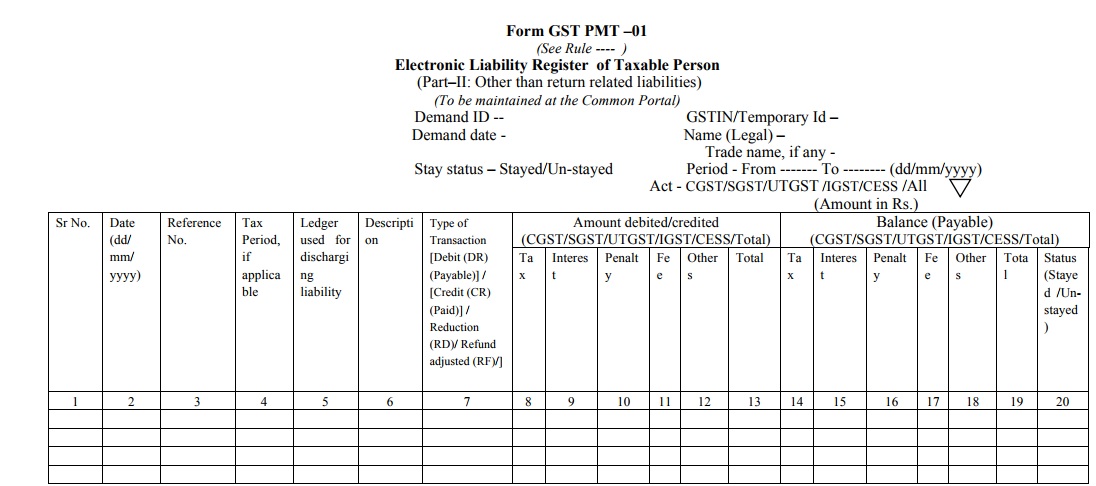

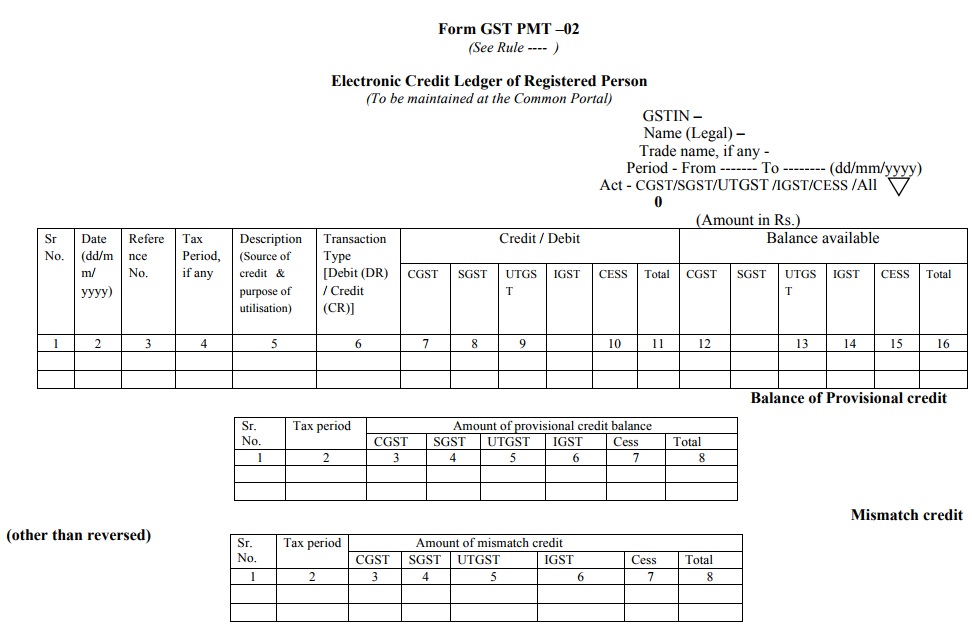

Form GST PMT-02

This form will be used to maintain electronic credit ledger information for each registered taxpayer eligible for ITC. The input tax credit claims will be credited to this ledger. The amount available in the credit ledger can only be used for the payment of taxes.

A taxpayer will pay his taxes in the following order:

- Tax and other dues related to previous tax returns

- Tax and other dues related to current tax return

- Any other amount payable

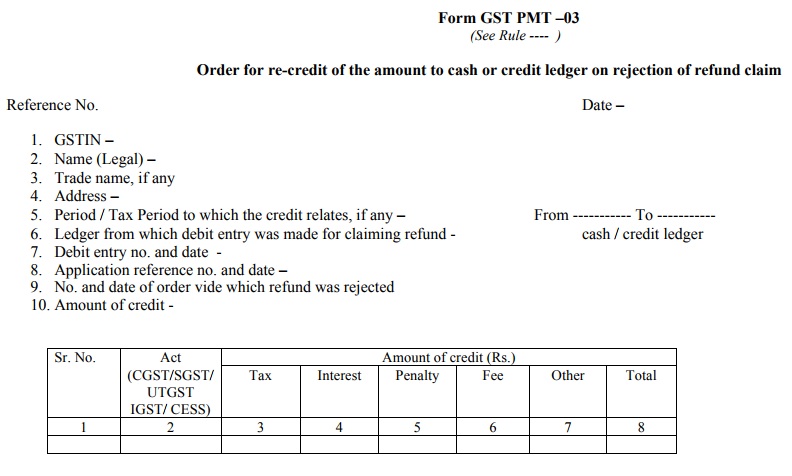

Form GST PMT-03

Form GST PMT-03 will be used by the proper officer to pass an order to re-credit the amount to the credit ledger on the rejection of refund.

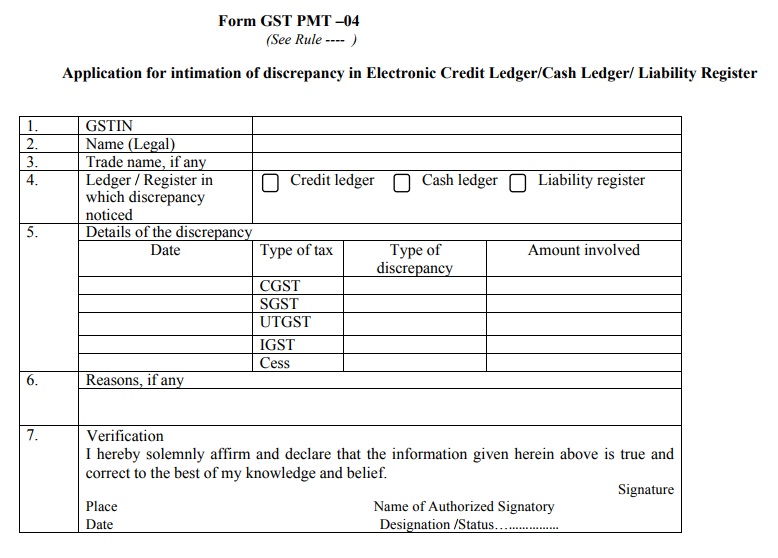

Form GST PMT-04

Form GST PMT-04 is to be used by a registered taxpayer to communicate any discrepancy in his/her electronic liability ledger/ cash ledger/ credit ledger to the relevant officer through the common portal.

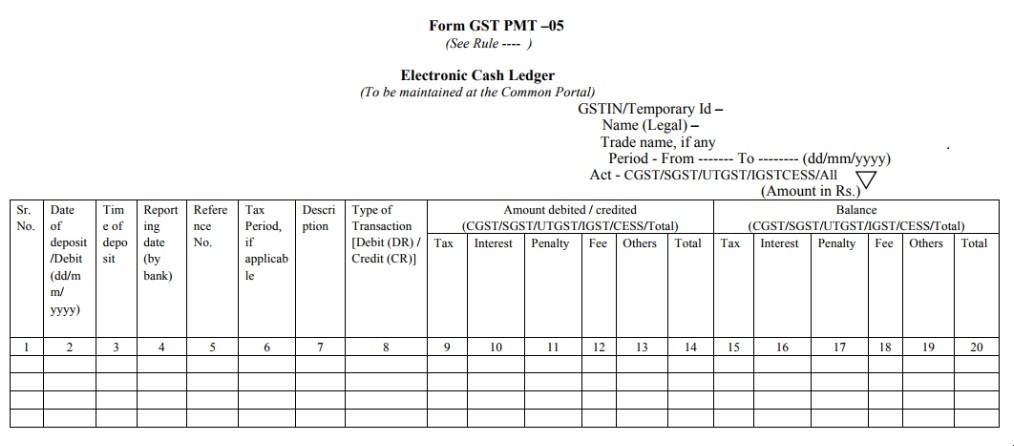

Form GST PMT-05

This form is used to maintain the electronic cash ledger for each registered taxable person. The payment of taxes, penalty, interest and other amounts will be credited to the cash ledger of the person which can be further used to pay the tax, interest, penalty, late fee and other amounts.

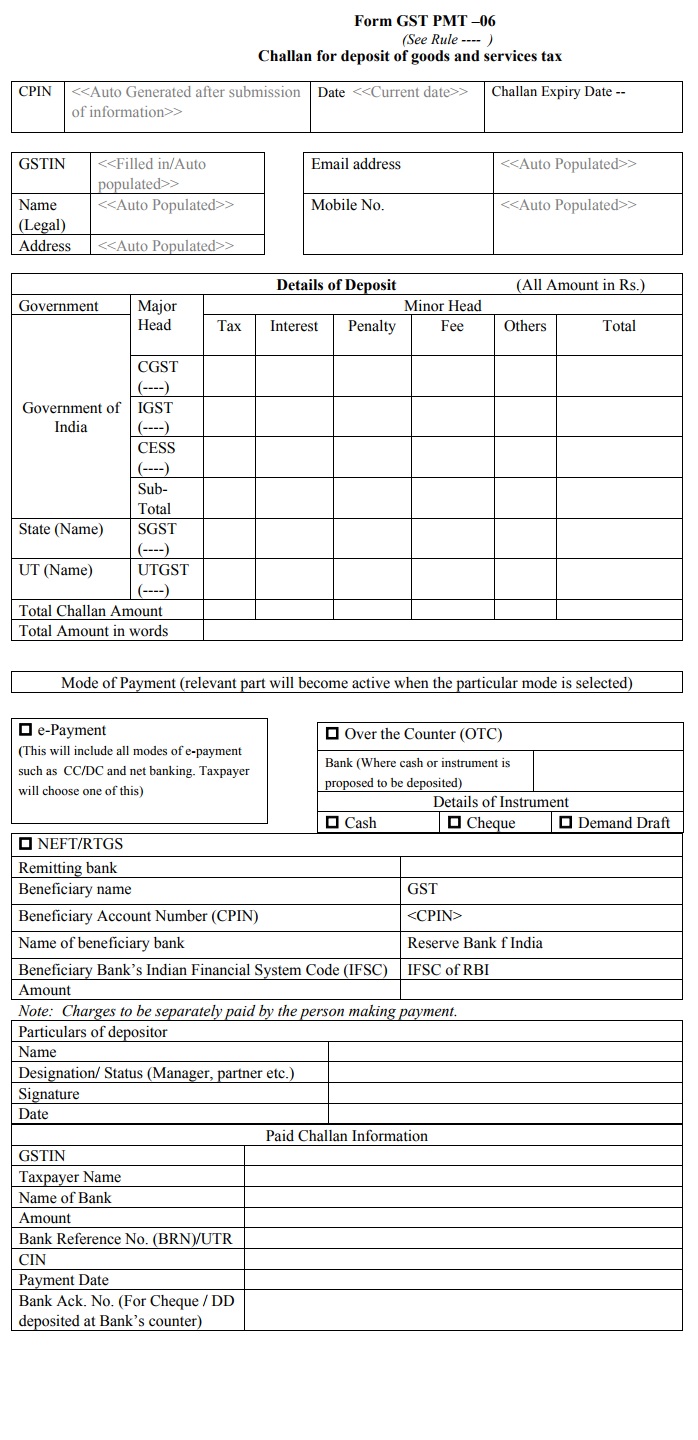

Form GST PMT-06

Form GST PMT-06 will contain the challan to be used to make the payment of tax, interest, penalty, late fees and other amounts. The validity of this challan is 15 days.

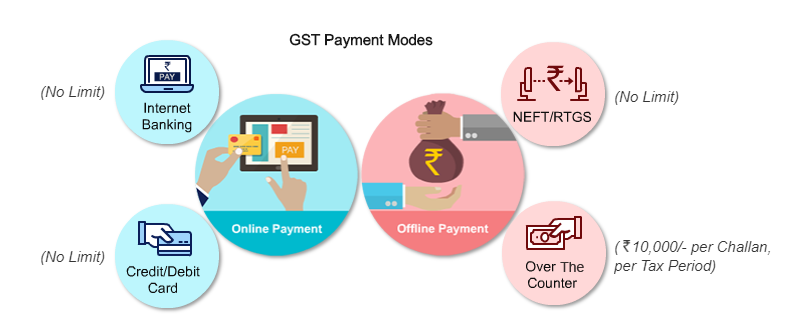

GST tax payment Online: The e Payment of GST can be made through any of the following modes:

- Net Banking

- Credit/ debit card

- NEFT or RTGS

- Over the Counter payment (OTC) – by cash, cheque or demand draft through authorized banks.

The limit for Over the Counter payment (OTC) is ten thousand rupees per challan per tax period, except to deposits made by the following persons/entities.

Government Departments or any other deposit to be made by persons as may be notified by the Commissioner in this behalf;

Proper officer or any other officer authorized to recover outstanding dues from any person, whether registered or not, including recovery made through attachment or sale of movable or immovable properties;

Proper officer or any other officer authorized for the amounts collected by way of cash, cheque or demand draft during any investigation or enforcement activity or any ad hoc deposit.

Under GST, online payments made even after 8 PM will also get credited to the relevant account on the same day. Any person who is not registered under the Act will be able to make payment by a temporary identification number generated through the Common Portal. The GST payment challan has to be generated only through GST Common Portal; No physical challans will be accepted for the GST payment.

For NEFT and RTGS payments, a mandate form along with the GST challan generation through the Common Portal and submitted to the respective bank. The validity of this form will also be fifteen days.

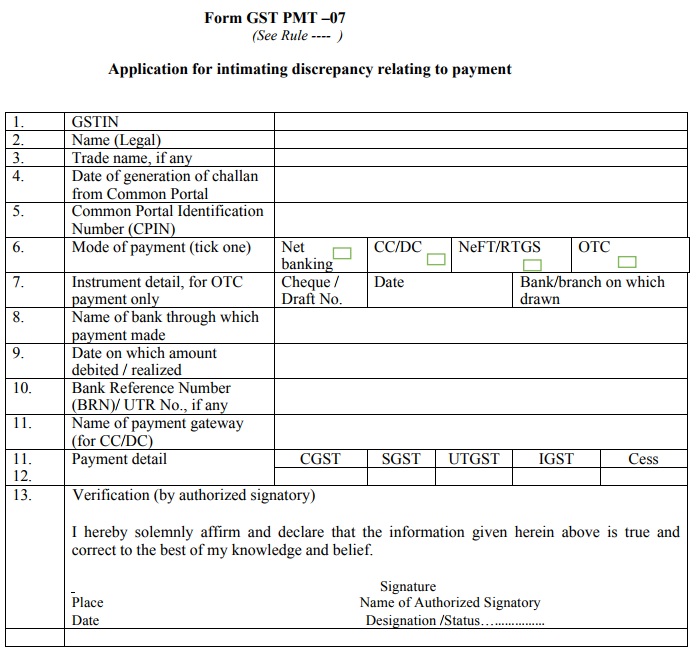

Form GST PMT-07

On successful payment of the tax amount to the concerned bank account, a Challan Identification Number (CIN) will be generated and made available in the challan of the taxpayer. The CIN indicates that the said amount has been credited to the electronic cash ledger of the respective person for which a receipt will also be generated by the Common Portal.

In case if the deposit amount is debited but no CIN is generated or not received by the Common Portal, the said taxpayer can use Form GST PMT-07 as an alternative.

Important Points

- A unique identification number shall generate for each debit/credit to the electronic credit or cash ledger.

- A person will not be allowed to change the amount of the challan once the CPIN (Common Portal Identification Number) is generated. A new challan has to be created to make any change in amount.

- A separate payment (cheque/ DD/ card payment) is to be issued for each challan.

- Taxpayers are allowed to save a partially filled challan on the GST Portal which can be accessed through the path – Services > Payments > My Saved Challans.

- The validity for saved challans is 7 days and a user can save at most 10 challans on the GST portal at any given time.

- The date of realization of challan in cash (cheque/DD) is marked as the payment deposit date.

- A third party person can make GST payments on behalf of a taxpayer.

Users can track their payments through one of the following two methods: - Pre-login mode: Visit Services > Payments > Track Payment Status on the GST portal

- Post-login mode: Visit Services > Payments > Challan History

- UTR can be used to update the NEFT/RGTS transaction with the RBI.

Interest and Penalty on late payment of GST

A person is liable to pay interest/penalty as per following conditions and rules.

- Any payment after the due date will attract an interest at the rate of 18%.

- If a person makes excess or undue claims of input credits or excess/undue reduction in tax liability, they will have to pay an interest at the rate of 24% on the excess claim or reduction amount.

- The penalty of 10% of the unpaid or short paid tax or Rs. 10,000, whichever is higher, is to be levied in case of non-payment of GST even after 3 months from the originally scheduled date.

- In case of a fraud or misstatement to escape tax, the penalty of Rs. 10,000 or 100% of the tax will be applicable.