Contents

What is ARN Number? And How does ARN status work under GST payment in India?

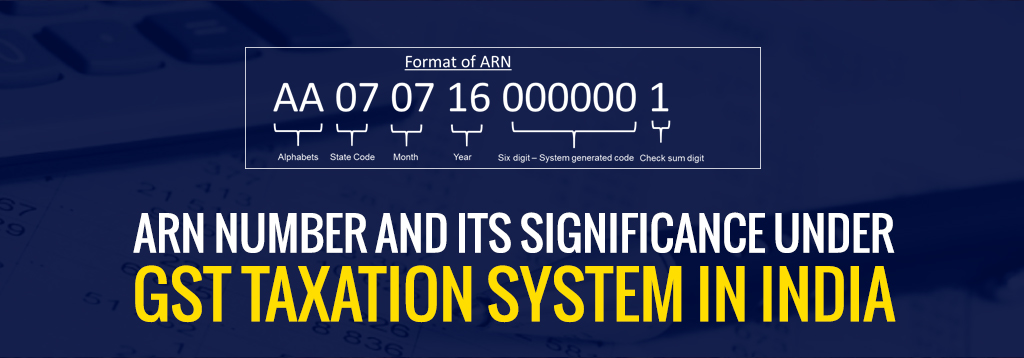

ARN number stands for Application Reference Number which is generated after the submission of the enrollment application, which is signed electronically or Digital Signature (DSC) at GSTN Portal. Under this, a unique number is provided for doing any transaction at GST System Portal. It must be noted that ARN no. can also be used in the future course of GST.

After submitting the enrollment application successfully at the GST System Portal, ARN number will be created automatically. In Fact, you also can use ARN for tracking the position of your enrollment application. ARN status will help existing taxpayers to migrate them into new Goods and Services Tax (GST). GST portal is the official portal created by the government authorities which will help to do all activities of GST through online. ARN number is basically used for checking GST registration status online.

ARN (Application Reference Number) status is the official proof that you have successfully applied for GST registration. It is a unique number that can be used to track the online status of your GST portal registration application.

After the implementation of GST system in India, each eligible taxpayer is required to register on the portal and file regular tax returns. Taxpayers are advised to keep their ARN secure as it will be used for many purposes in addition to checking the ARN number status.

Documents Required for ARN (Application Reference Number):

- Directors or partners list along with their identification and address proof. It is necessary to mention that you are doing business in the partnership or incorporation

- Memorandum of Association (MOA)/ Articles of Association (AOA), Certificate of incorporation, partnership deed

PAN Card of Business Organization - Canceled cheque of bank account in which mentioned account holder name, IFSC code, MICR and branch details of bank

- Rent agreement or electricity bill as a feature and document of area of business

How to check ARN Status?

- Go to this link – https://www.gst.gov.in/

- Click on ‘Existing User Login’ Button

- Enter ID, Password, and Captcha

- Click ‘Continue Button’ on next page

- Click ‘Saved Application’ on top tab

- Application Status will be displayed

Also, your ARN Number Status will be sent to your registered mobile number.

Important Announcement According to GST portal:

- If a Taxpayer has received application reference number (ARN), then he/she should be able to download the Provisional Registration Certificate from ‘Download Certificates’ available at GST website.

- Any Taxpayer, who has saved the enrolment form with all details but has yet not submitted the same with DSC, E-Sign or EVC, then he/she will receive the ARN at their registered email ID, if the data given are successfully validated. And if validation fails, the taxpayer would be able to log into the same portal onwards and correct the errors. One can also get the details of the errors via registered email.

- A Taxpayer, who has partially completed the enrolment form can log in to the portal from the above-mentioned date and complete the rest part of the form.

- If An existing Taxpayer wishes to register under GST then he /she will be able to apply for new registration at the GST portal.

Sir.Heartly Namaskar.i get TRN No saved for 17/7/2017.I failed to comp Regn all 4 steps during 17/7.TRN expired.further i am trying for new GST Regn,says on portel screen an appliction has been initiated with combination of PAN EMIL MOBILENO .please login with TRN.if i login first time without TRN login requires user name & password.which is not with me.i have mandetory for GST REGN as a CSC VLE of digibimdia .now what i do please explain

My gst number searching

AA2307171375049 my arn no how could i when will i get gst no from madhya pradesh help me out

I have apply for gstn before one month.but not successfully yet.kindly help me.

My ARN No-AA290817057086Q

Request you to please process GST No as soon as possible

My r is cancelled by vat hence provisional id stands cancelled.

It’s under process of reactivation.can I use this provisional id to purchase goods and billing until it is reactivated.plz help

I have applied for GST twice but both the time after getting ARN number GST number is not allotted and the status remains to be pending. Please help me , why this is happening.

Sir,

i have submitted show cause notice reply successfully submitted on 23 august 2017, satus shows pending for order, I got ARN but still I have not received e mail or gst Provisional Number?

Sir I have 091700322027TRN when I will get GST no and how to check trn no

Sir, I fill the GST for my partnership firm but unfortunately its make the GST with my individual PAN No. , so my partnership firm become proprietor firm so what i have to do. my lawyer fill the ammend form but one month has passed but there is no news fro GST No. Please suggest me further……

how to get arn no under gst registered

Submit the enrollment application form at the GST System Portal, ARN number will be created automatically.

Check how to submit enrollment form.

forget arn no how can recover

First, login with your account details on GST portal then Click on the Dashboard > My Saved application command, where you can see your ARN status.

IgotARN –AA191017005030Z.BUT NOT RECEIVE GST TILL TODAY.WHAT IS THE POSITION??

Please check your ARN number status here.

My ARN NUMBER AA091117044022O SIR PLEASE HELP ME

Please check your ARN status here:

ARN Number Status

my arn no AA091017112303R PLZ help me pending for processing ARN NO

Check your ARN status here.

If it is pending for processing, it will be approved after some time according to the procedure.

AA0911180514754 my arn no of 20 day not allowed my gst no

It will be provided after approval.