Contents

What is GSTR 9A

GSTR 9A is an annual return form necessary to be filed by the composition scheme dealers at the year-end. The GSTR 9A form includes all the details of SGST, CGST and IGST paid and transactions based on them of the whole year.

Here, GST Helpline will describe all the necessary information of GSTR 9A format and its definition along with updated due date and taxpayers liable for filing GSTR 9A form.

The article will discuss on the GSTR 9A for composition taxpayers in which they have to fill out whole year details of GST transactions occurred within the SGST, CGST and IGST criteria.

Definition of GSTR 9A Composition Annual Return Filing Form

GSTR 9A form is mandatory for all the composition scheme dealers to file annual returns comprising all the details of CGST, SGST and IGST transactions at the end of the year.

The GSTR 9A form for composition scheme dealers will be having all the quarterly returns filed during the financial year. The filing includes all the details of supplies made in the financial year in a consolidated proportion i.e. (monthly/quarterly returns).

Who are liable to file GSTR 9A return?

All the composition scheme dealers are required to file GSTR 9A annual return form on or before 31st December of next financial year.

The due date for filing GSTR 9A?

Extended GSTR 9A due date is 31st January 2020 for FY 2017-18, so all the composition scheme dealers must include all the details of the whole year having SGST, CGST and IGST transaction information.

In case anyone comes across through any query or filing issues, you can contact us through the comment section and our tax experts and chartered accountants will solve your all the issues and doubts at the earliest.

- GSTR-9A due date for FY 2017-18 – 31st January 2020*

- GSTR-9A due date for FY 2018-19 – 31st March 2020* (Check Notification)

Also Read: GSTR 9 Annual Return: PDF Format, Filing Procedure and Eligibility

Easy Steps for Filing GSTR-9A Form Online for Composition Taxpayers

The GSTR-9 Form has been categorized into 5 Main Parts called with Part-I, Part- II, Part III and so on. The detailed information regarding the GSTR 9A Form is mentioned below just have a quick look once:

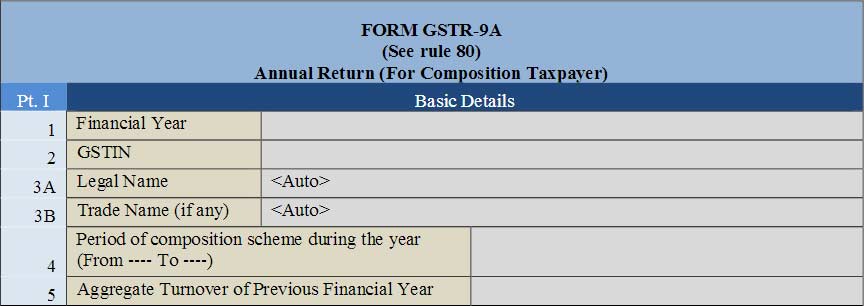

Part 1

Part 1 consists of basic details such as GSTIN, Legal Name, Trade Name which is categorized into 5 different sections and 6 rows. The details of Part 1 is auto-populated.

1 Financial Year: The Financial year is a year wherein the taxpayer is entitled to file the return

2 GSTIN: GSTIN, dubbed as GST Identification Number. A state-wise PAN-based 15-digit Goods and Services Taxpayer Identification Number (GSTIN) is allocated to every registered taxpayer.

- 3A Legal Name is Auto- Populated while log-in

- 3B If trade name any, auto-populated on log-in

4 Period of Composition Return From ____ To ____ Shortly, it is a tax duration period where the taxpayers have to mention the particular dates.

5 Aggregate Turnover of Previous Financial Year: A composite turnover of the previous year

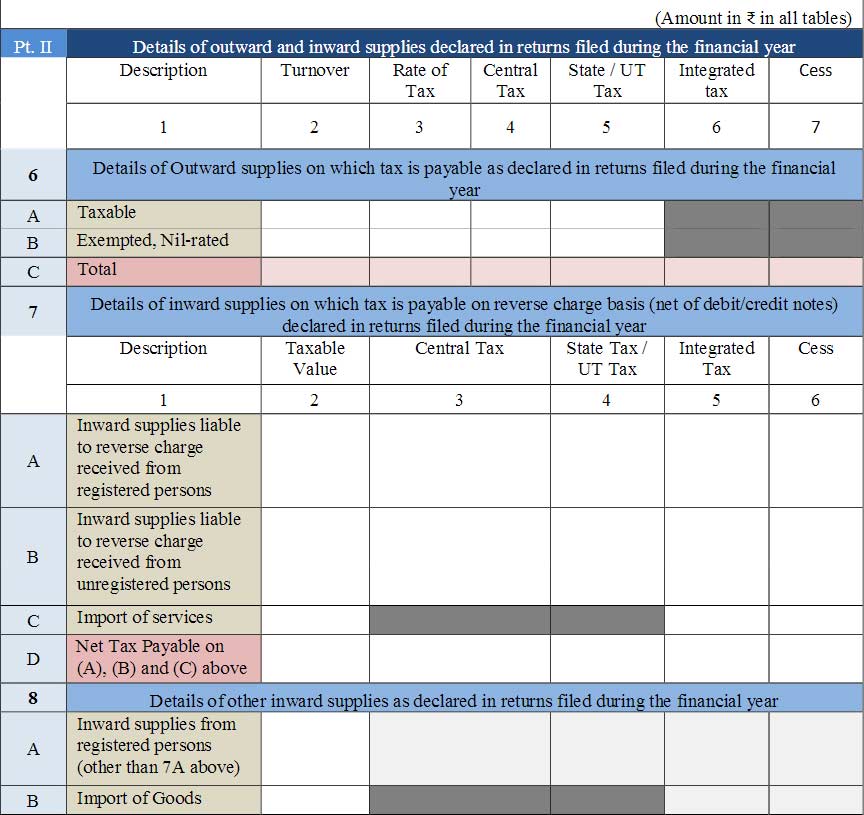

Part II

Under this part, you have to mention all the information of outward supplies and advances received in the period of the financial year. Further, it is categorized into 3 sections and 9 subsections. Just have a quick look at the details mentioned below:-

6 Under this, you have to mention the information of Outward Supplies on which tax is payable as declared in returns filed during the financial year.

- 6A Here you have to provide the details of Taxable outward supplies including Turnover, Rate of Tax, Central Tax, State / UT Tax, Integrated Tax, Cess

- 6B include information of Exempted, Nil-rated outward supplies such as Turnover, Rate of Tax Central Tax State / UT Tax, State / UT Tax, Integrated Tax, Cess.

- 6C is a computation of 6A and 6B details

7 Here you have to provide all the details relating to inward supplies on which tax is payable on the reverse charge basis

- 7A Under this, you have to provide the details of Inward supplies liable to reverse charge collected from the registered persons. It consists of Taxable Value, Central Tax, State Tax / UT Tax, Integrated Tax, Cess.

- 7B Here you have to mention the Inward supplies liable to reverse charge received from the unregistered persons. It consists of details like Taxable Value, Central Tax, State Tax / UT Tax, Integrated Tax and Cess.

- 7C Consist Details of Import Services

- 7D Headed With Net Tax payable which is an addition of all (A), (B) and (C ) sections

8 Under this, you are required to provide other inward supplies as declared in returns filed during the financial year

- 8A include inward supplies collected from the registered persons (excluding 7A above). Here Inward supplies non- liable for RCM

- 8B Here details of Import of Goods are required such as Taxable Value, Integrated Tax, and Cess details of imported goods.

Recommended: How to File GSTR 9C Return Online

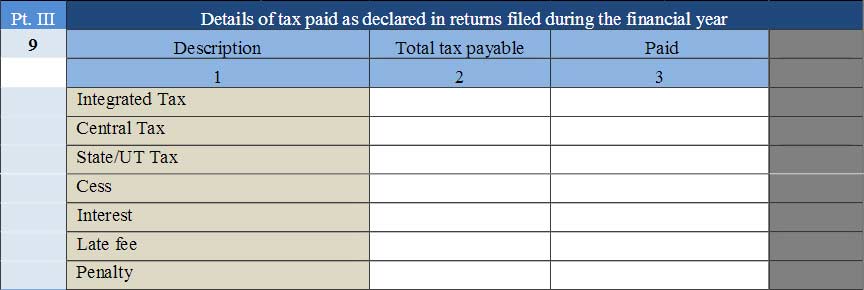

Part III

9 Under this, an individual is entitled to provide the information of tax paid as announced in returns filed during the financial year. It consists of paid taxes under various GST tax heads during the financial year. It includes Integrated Tax, Central Tax, State/UT Tax, Cess, Interest, Late fee and Penalty.

It includes a computation of total tax payable as well as taxes paid under different GST head during the Financial Year.

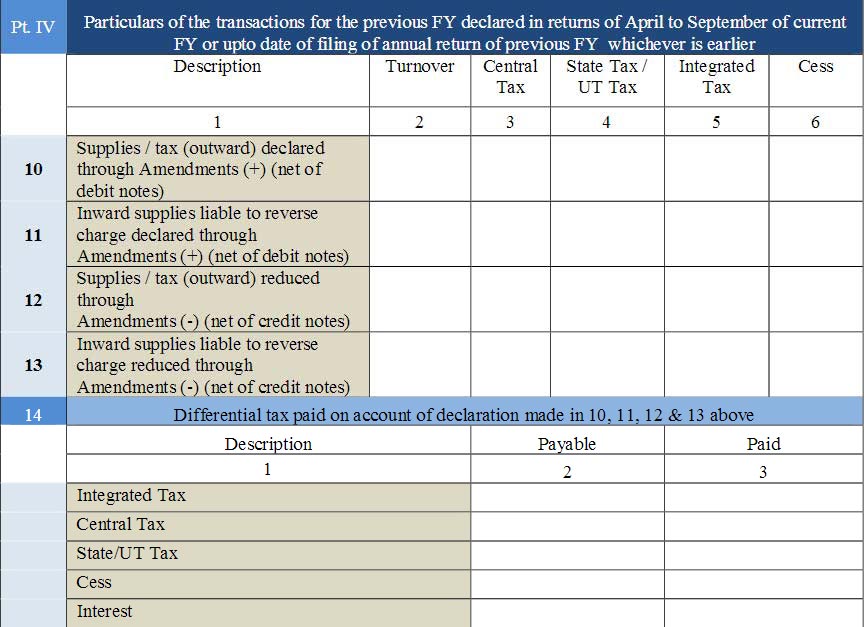

Part IV

It consists items of the transactions for the earlier FY as announced in returns of April to September of current FY or till the date of filing of annual returns of previous FY which happens earliest :

10 It includes details of Supplies/tax (outward) declared through Amendments (+) (net of debit notes)

11 Here you have to provide the details of Inward supplies liable to reverse charge declared through Amendments (+) (net of debit notes)

12 It includes Supplies/tax (outward) diminish through Amendments (-) (net of credit notes)

13 It includes Inward supplies responsible for reverse charge diminished through Amendments (-) (net of credit notes)

14 Includes different taxes paid under GST heads such as Integrated, Central, State/UT Tax, Cess and Interest under GST heads in 10, 11, 12 & 13 above.

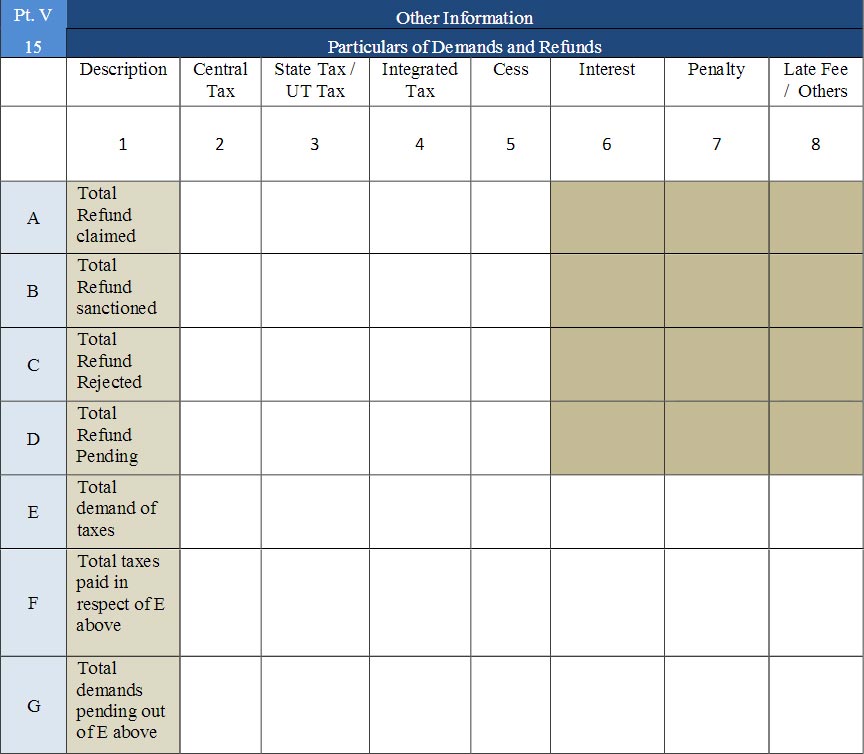

Part V Consists of Other Information

Part V

Under this section, you can provide all the information relating to the demands and refunds. It includes details like refunds claimed, total refund sanctioned, total refund rejected and more. It is categorized into different sections:-

- 15A Include Total Refund Claimed, here you have to provide all the details relating to claim such as Central Tax, State Tax / UT Tax, Integrated Tax and Cess.

- 15B Include Total Refund sanctioned: A computation of tax elements of refunds sanctioned such as Central Tax, State Tax / UT Tax, Integrated Tax and Cess.

- 15C Include Total Refund Rejected: A computation of tax elements (same as mentioned above) of refunds rejected

- 15D Include Total Refund Pending: A computation of tax elements (same as above) of refunds rejected

- 15E Include Total Demand of Taxes Here you have to mention a total demand of taxes you are liable to pay (same as mentioned) in the first point

- 15F Total taxes paid in respect of E above: Mention a total of tax elements in association with point E above

- 15G Total demands pending out of E above: Enter detail of total uncleared tax components with respect to point E above

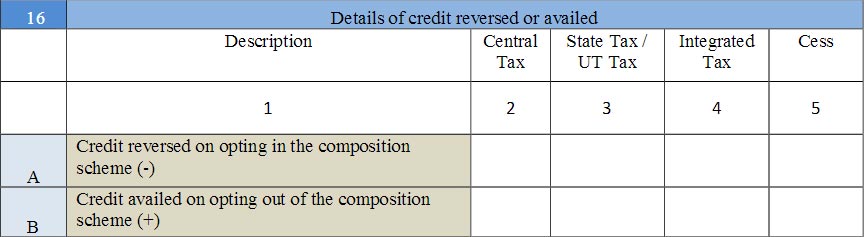

16 Here you are required to provide details of credit reversed or availed

- 16A Here you have to mention the details of credit reversed while opting the composition scheme (-)

- 16B Here you have to provide the details of Credit avail when you are withdrawing from the composition scheme (+)

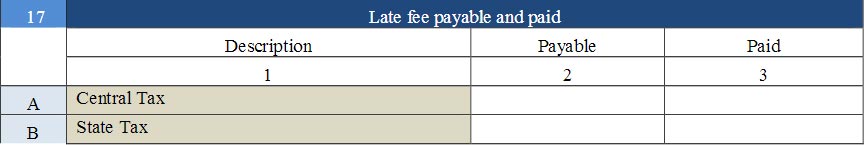

17 Late fee payable and paid:

Under this, you have to mention the details of penalty fee or the individuals who have already paid the penalties

- 17A Central Tax: Here you are required to provide the payable and paid Central Goods and Services Tax (CGST)

- 17B State Tax: Here you have to mention the payable and paid State Goods and Services Tax (SGST)

After filing GSTR 9A Form, the assessee is required to sign the form either a digital signature certificate (DSC) or Aadhaar based signature to verify and validate the details of return.