GSTR 8 is one of the GST returns that is to be filed monthly by e-commerce operators who charge TCS (Tax Collected at Source). Continue reading to find out more about GSTR 8 format, eligibility to file, due date, penalties, the return filing process, making revisions, etc.

Contents

About GSTR 8 Return

GSTR 8 is a special GST return which is filed by e-commerce companies who deduct TCS (Tax Collected at Source) from their consumers. The return includes the details of supplies made by an e-commerce operator through its online platform and the TCS collected on these supplies.

GSTR-8 is to be filed by every eCommerce company operating and making supplies in India and registered under GST.

Any person who makes supplies through an online/digital/electronic store or platform is treated as an e-commerce operator for the purpose of GST. One example is Amazon. All e-commerce operators operating in India are mandatory to register for GST and deduct TCS from the suppliers.

The Purpose of GSTR-8 Form

The sole purpose of GSTR 8 format is to maintain correct details of the TCS amount collected by e-commerce operators on supplies made through their platform. This is to ensure a seamless flow of input credit to the suppliers who paid TCS to the e-commerce operator. The respected supplier can see the TCS details in Part C of their GSTR-2A return form.

The TCS collected by the e-commerce operator goes directly to the government which can be eventually recovered by the concerned supplier through input credit mechanism.

GSTR 8 Due Date

GSTR-8 is to be filed every month by e-commerce operators in India. The usual date for filing GSTR-8 is 10th of the next month for a particular tax period.

Note: GSTR 8 due dates for filing are-

- April 2019 –

10th May 2019 - May 2019 –

10th June 2019 - June 2019 –

10th July 2019 - July 2019 –

10th August 2019 - August 2019 –

10th September 2019 - September 2019 –

10th October 2019 - October 2019 –

10th November 2019 November 2019 – 10th December 2019- December 2019 –

10th January 2020 - January 2020 – 10th February 2020*

Penalty: A penalty of Rs 200/day (Rs 100 CGST + Rs 100 SGST), not exceeding Rs 5,000, will be levied on late filing of GSTR-8, starting from the next day after the due date. The concerned party will also have to pay an interest at 18% per annum on the due amount.

When is TCS applicable under GST?

Tax Collected at Source or TCS came into effect under GST on 1st October 2018. The Central GST Act entitles E-commerce operators like Flipkart, Amazon, Jabong, Ebay to collect TCS at the rate of 1% from suppliers on its platform. This rate would be applicable to the net value of supplies i.e goods and services taxable under GST barring a few exceptions. The CGST ACT also mandates e-commerce operator to register for TCS and file GSTR-8 Return Form on a monthly basis.

How to Calculate Net Value of Supply?

Net Value Of supplies is the total value of the taxable supplies made by registered suppliers through the operator. These supplies will also include goods and services specifically notified by the government under section 9(5). The aggregate figure will not take into account or deduct the value of those goods or services returned to the supplier by the operator.

How to File GSTR-8? (Step by Step Procedure)

The GSTR-8 form can be filed online on the GSTN portal by registering and signing in to your account. It will include the following details.

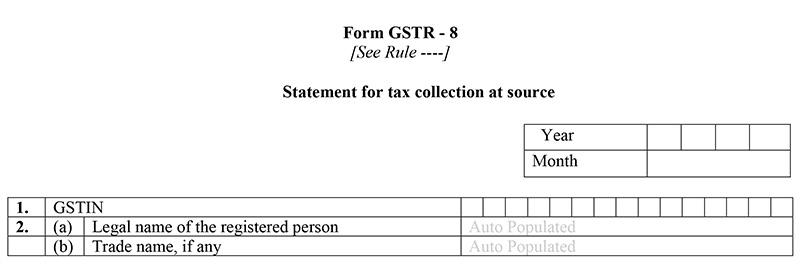

1 & 2. Details of Taxpayer

a. GSTIN: The 15-digit GST Identification Number assigned to you at the time of registration.

b. Legal name of the GST registered person: The name of the registered taxpayer will auto-populate based on the GSTIN.

c. Year & Month of the tax period.

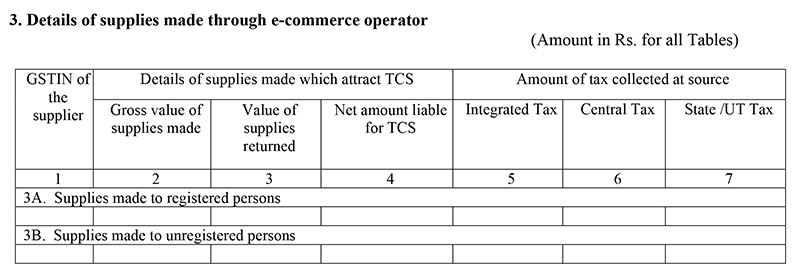

3. Details of supplies made through e-commerce platform

It will include the gross value of supplies that were made through your e-commerce platform to registered and unregistered persons and the value of supplies which were returned by these recipients. The net amount liable for TCS would be the difference between the values of the total supplies made and the ones returned.

Table 3A will contain the details of supplies made B2B, or to registered persons/businesses, including their GSTIN, the gross value of total supplies, the value of returned supplies, net supply value, etc.

Table 3B will have the details of supplies made B2C, or to unregistered persons.

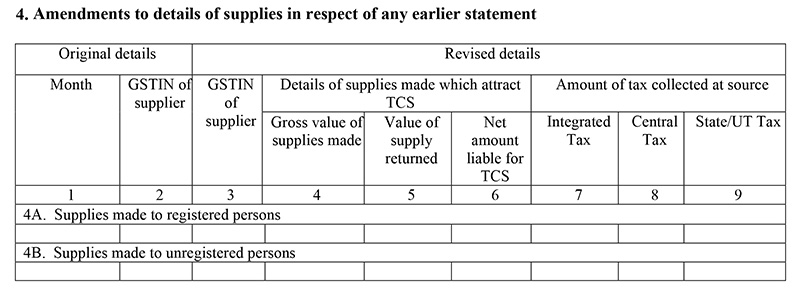

4. Amendments to details of supplies in respect of any earlier statement

In case, if you need to change the details of supplies filed in any previous return/statement, it can be done in this head.

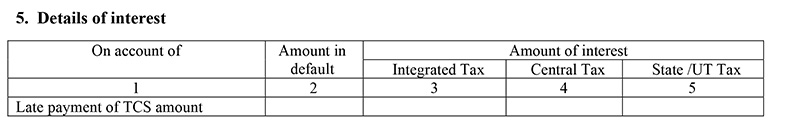

5. Details of Interest

For late return filing, this field contains the details of interest (IGST, CGST & SGST), in addition to the actual TCS amount. The information in auto-populated from above tables.

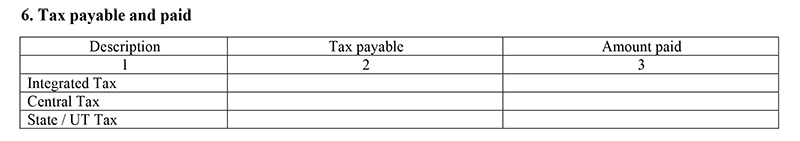

6. Tax Payable and paid

Based on the information provided in above heads, the net amount of the TCS applicable for a particular tax period will auto-popular in this table.

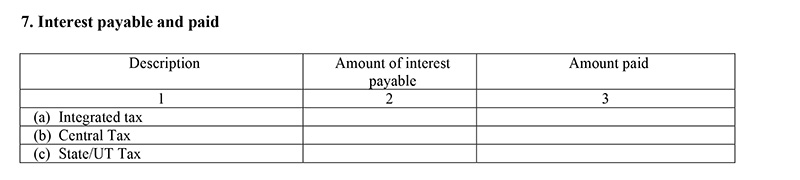

7. Interest payable and paid

It will contain details of the net amount of interest @18% payable and paid on the late payment of TCS.

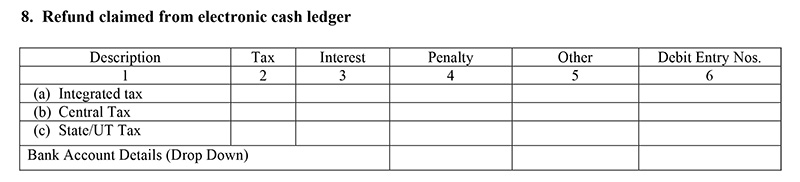

8. Refund claimed from electronic cash ledger

When all the previous TCS liability is paid, the refund can be claimed and details can be furnished here.

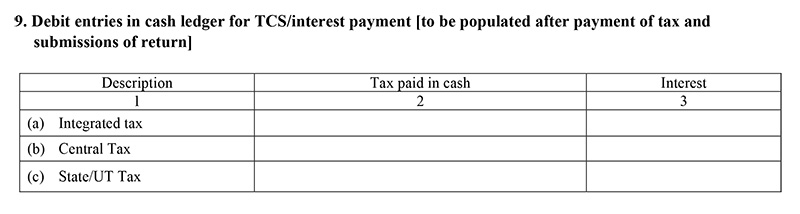

9. Debit entries in cash ledger for TCS/interest payment [to be populated after payment of tax and submissions of return]

Once the tax is paid and the return is submitted, the details of TCS will automatically appear in Part C of GSTR-2A of the respective supplier.

At the bottom, the taxpayer will provide an electronic signature to verify and confirm the details provided in the form.

Important Terms Used in the GSTR 8 Form

GSTIN: Goods and Services Taxpayer Identification Number

UIN: Unique Identification Number

UQC: Unit Quantity Code

HSN: Harmonised System of Nomenclature

SAC: Services Accounting Code

POS: Place of Supply of Goods and Services

B2B: from one registered person to another registered person

B2C: from registered person to unregistered person

Making Revisions in GSTR-8 Filing

GSTR 8 details cannot be revised once the form is submitted successfully. However, the registered person can correct the mistakes made by him in a current return while filing GSTR-8 of the next month or any other subsequent month.