GSTR 6 is a GST return form that is required to be filed monthly by every input service distributor (ISD). It will contain the details of invoices of the credits received by that distributor along with the ITC distributions made by him in that month. All eligible ISDs need to register on the GSTN portal in order to file their monthly returns.

GSTR 6A is another return form that will generate automatically with the inward supplies details (to ISD) provided by the supplier in their GSTR 1 Form. The ISD can check this form and approve the details as provided by his/her supplier and use the same to fill his own GSTR 6 Form.

Contents

What is GSTR 6 Return?

GSTR 6 is one of GST return forms that have to be filed by an input service distributor (ISD) providing the details of input credit received by him/her and distribution of ITC. The form contains 11 sections in total.

GSTR 6 Form is used to provide the details of all the invoices issued in regards to the distribution of ITC and also mentions the manner of distribution of credits.

Every registered ISD has to file GSTR 6 return on a monthly basis even if it is a Nil return.

GSTR 6 Filing Due Date

The Regular GSTR 6 due date for return filing is 13th of each month for a previous tax month.

Next GSTR 6 Due Date:

- April 2019 –

13th May 2019 - May 2019 –

13th June 2019 - June 2019 –

13th July 2019 - July 2019 –

13th August 2019 - August 2019 –

13th September 2019 - September 2019 –

13th October 2019 - October 2019 –

13th November 2019 - November 2019 –

13th December 2019 - December 2019 –

13th January 2020 - January 2020 – 13th February 2020*

Note: The late fee payable for failure to furnish Form GSTR 6 filing shall be Rs. 50 per day.

Who should file GSTR-6?

Every eligible input service distributor, except for the following, has to file this return.

- Those registered under the composition scheme

- Those liable to collect TDS or TCS

- The suppliers of OIDAR

- Non-resident taxable persons, and

- Compounding taxpayers

Who is an Input Service Distributor?

An input service distributor or ISD refers to the office of the supplier of services and/or goods that:

- Receives tax invoices in regards to the receipt of input services;

- Issues invoices and other documents in regards to the distribution of credit;

- Distributes input tax credit paid on these services to the supplier of goods/services who has the same PAN as the ISD office.

The input service distributor will file GSTR-6 providing the invoices and documents containing the details of ITC and its distribution.

GSTR 6 Format and Filing Procedure

An ISD needs to furnish the following details in his/her GSTR 6 Format. Some of these details will auto-populate based on the information in GSTR-6A.

Download the GSTR 6 Form in PDF Format

How to file GSTR 6? let’s check out the filing process here:

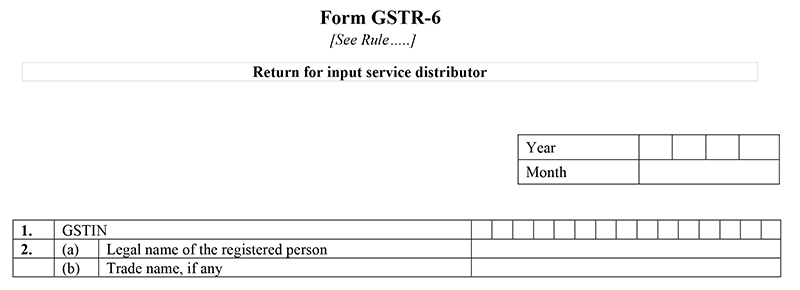

Table 1 & 2: Details of the ISD

1. GSTIN – Enter the GSTIN number of the input service distributor.

2. (a) Legal name of the registered person

(b) Trade name, if any.

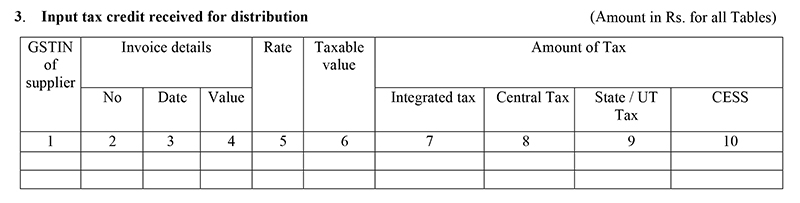

Table 3: Input Tax Credit received for distribution

This table will contain the details of all the input credit along with relevant invoices received by the ISD and distributed further. The data will be auto-populated in this head.

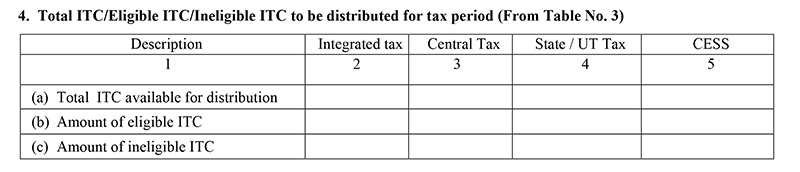

Table 4: Total ITC/ Eligible ITC/ Ineligible ITC to be distributed for tax period

Provide the details of the input credit, including eligible and ineligible ITC, received on CGST, IGST, SGST and CESS, and distributed further, for that tax period.

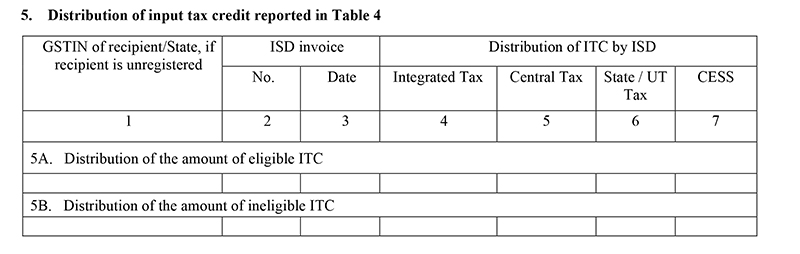

Table 5: Distribution of input tax credit reported in Table 4

This table contains the details of the distribution of eligible and ineligible ITC by the input service distributor, including the details of the recipient of input credit. Based on the information provided in this head, the dealer will be able to claim the ITC.

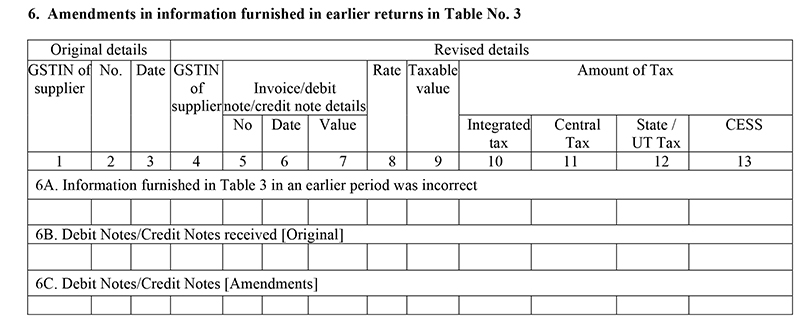

Table 6: Amendments in information furnished in earlier returns in Table No. 3

If the input service distributor needs to make any changes or modifications in the credit invoices provided in (Table No. 3 of) the previous returns, it can be done through this head. The original details provided in the previous returns along with changes need to be entered here.

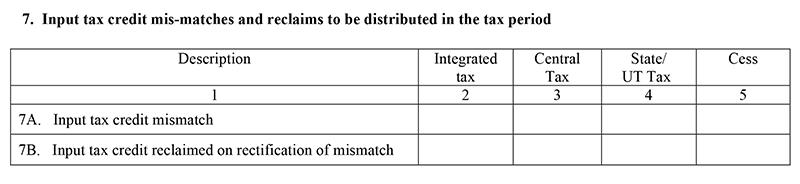

Table 7: Input tax credit mismatches and reclaims to be distributed in the tax period

This head will contain the information of the changes to be made to the total Input Tax Credit on account of any mismatch and on ITC reclaimed on rectification of mismatch.

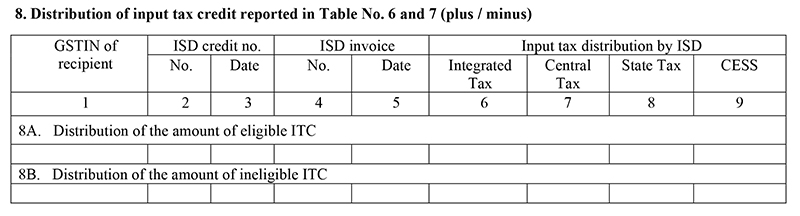

Table 8: Distribution of input tax credit reported in Table 6 and 7 (plus/minus)

If any changes are to be made to the ITC amount distributed to dealers as reported in table 6 and 7, the same should be mentioned here.

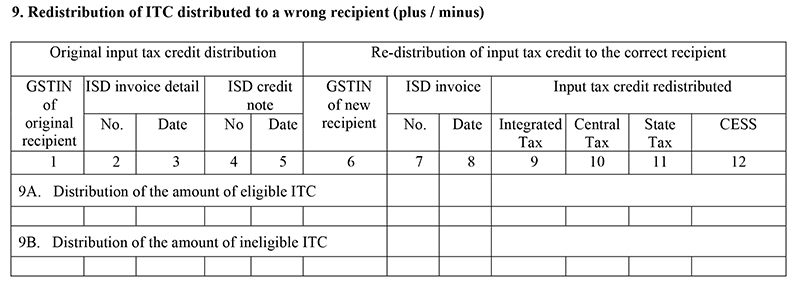

Table 9: Redistribution of ITC distributed to a wrong person (plus/minus)

The details of corrections for any wrong ITC distributions made in the previous returns will be filed here.

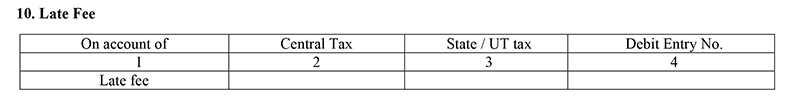

Table 10: Late Fee

The input service distributor will provide the details of any late fee paid or to be paid by a dealer on any type of GST.

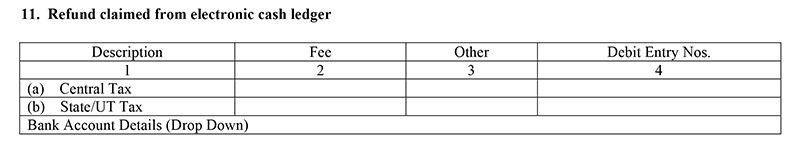

Table 11: Refund claims from electronic cash ledger

The details of the refunds to be claimed for any wrong ITC paid or anything else will be mentioned in this table.

The input service distributor needs to provide his/her signature at the end of the form confirming the correctness of the information provided in the GSTR 6 Format.

gstr6 filling process

GSTR 6 filing process is already explained in this post with images.