A bill of supply is another important document under the GST compliant tax regime. In this article, we will discuss the importance of a bill of supply, why it is used? and most important – Bill of supply format.

What is a Bill of Supply in GST?

As you probably already know, a GST invoice is issued by the supplier for the supply of items on which GST is applicable and tax details are required to be mentioned in the invoice. A bill of supply is a commercial document issued by the supplier to the recipient on the supply of goods where GST is not applicable (not charged). It does not contain any tax information.

When is a bill of supply issued?

A bill of supply is to be issued for every supply of goods of value more than Rs. 200 in one of the following cases.

- Supplies made by a GST unregistered person: Businesses with turnover less than 20 lakh (or 10 lakh in some states) and not registered under GST can issue a bill of supply to the customer for all the supplies over Rs. 200 value. The bill of supply will not mention any tax including CGST, SGST and IGST details, and so shopkeepers are not eligible to collect tax from their customers on these bills.

- Supplies of GST-exempted goods: All business entities dealing in the supply of GST-exempted goods are required to produce a bill of supply instead of a GST invoice.

- Composition registered suppliers: Taxpayers registered under GST composition scheme can only produce a bill of supply as they are not eligible to collect any tax from their customers. Also, the bill of supply issued by these composition dealers must mention the line “composition taxable person, not eligible to collect tax on supplies” at the top.

- Exports: Since the export of goods is zero-rated under GST, the supplier can issue a bill of supply as a proof of the transaction. This bill will not contain any tax information and should mention the following lines in the bill.

“Supply Meant For Export On Payment Of IGST” (If IGST has been paid)

“Supply Meant For Export Under Bond Or Letter Of Undertaking Without Payment Of IGST” (If IGST is not paid)

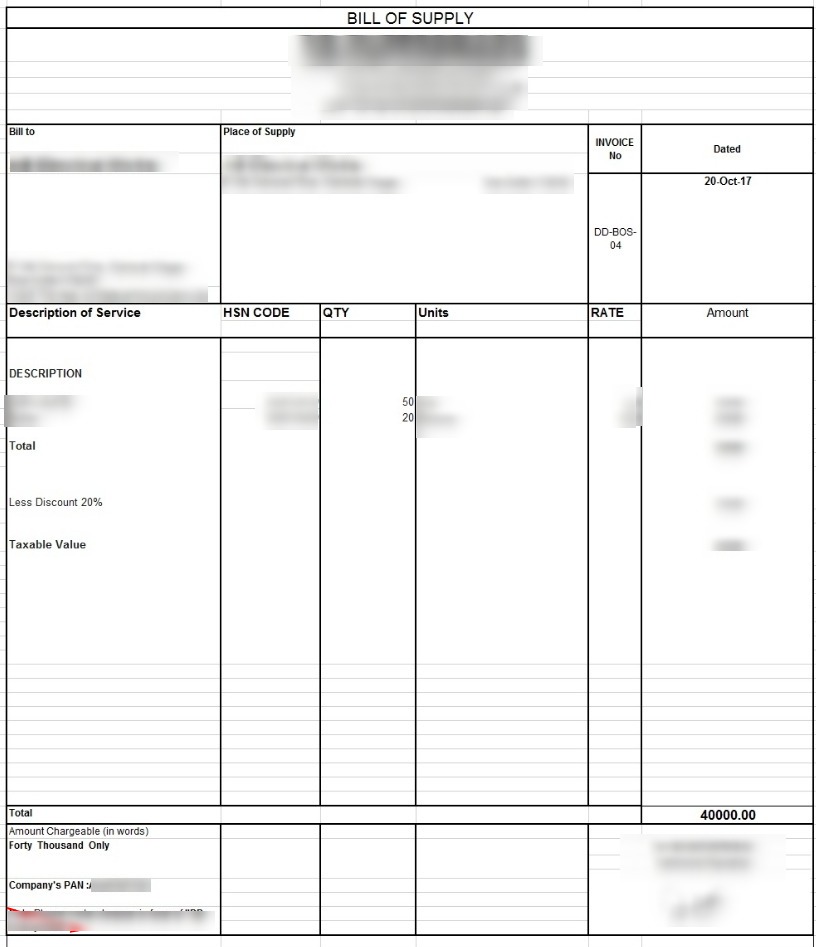

Bill of Supply Format

Download Bill of Supply Format in Excel

The bill of supply must contain the following information.

(a) Name, address and GSTIN of the supplier;

(b) a serial number, not more than sixteen characters, in one or more multiple series, containing alphabets or numerals or special characters “-” and “/”, and any combination thereof, unique for a financial year;

(c) Date of issue of the bill;

(d) Name, address and GSTIN or UIN of the recipient (if registered under GST);

OR

Name, address and place of supply of the recipient for supplies of over Rs. 50,000 (if not registered under GST);

(e) HSN Code of goods or SAC for services (to be mentioned only by businesses with annual turnover more than Rs. 1.5 crores);

(f) Description of goods or services or both;

(g) The value of supply of goods or services or both taking into account discount or abatement, if

any; and

(h) Signature or digital signature of the supplier or his authorized representative.