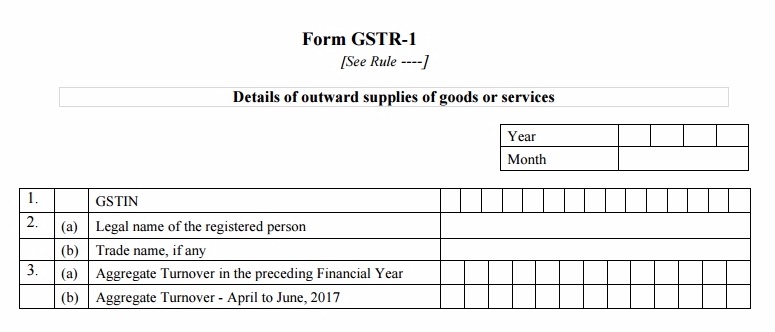

GSTR-1 is one of the GST tax return forms. It is used to submit the “Details of outward supplies of goods and/or services.” Every registered taxpayer under GST has to submit the GSTR-1 with required details by 10th of next month for a particular tax period.

GSTR 1 is a monthly or quarterly return to be filed by the registered taxpayer, it can be filled online through your taxpayer account on GST portal. The form is divided into 13 tables, most of which will be automatically filled based on the profile information of the particular taxpayer.

Composition taxpayer does not need to file sales return form under GST. Such taxpayers need to file GSTR-4 every quarter.

Revised Due Dates for GSTR-1 Turnover up to Rs 1.5 Crore

| GSTR-1 Due Dates (Up to Rs 1.5 Crore) | |

| Months (Quarterly) | Due Dates |

| Jan – March, 2019 | |

| April – June, 2019 | |

| July – Sept, 2019 | |

| Oct – Dec, 2019 | 31st January 2020* |

Note: For all the newly migrated taxpayers GSTR 1 due date ((Turnover Up to Rs 1.5 Crore) for all the quarters from July 2017 to December 2018 extended till 31st March 2019.

Revised Due Dates for GSTR-1 more than Rs 1.5 Crore

| GSTR-1 Due Dates (More than Rs 1.5 Crore) | |

| Monthly | Due Dates |

| Jan, 2019 | |

| Feb, 2019 | |

| March, 2019 | |

| April, 2019 | |

| May, 2019 | |

| June, 2019 | |

| July, 2019 | |

| August, 2019 | |

| September, 2019 | |

| October, 2019 | |

| November, 2019 | |

| December, 2019 | |

| January, 2020 | 11th February 2020* |

Note: GSTR 1 due date (Turnover above Rs 1.5 Crore) for all the newly migrated taxpayers is extended till 31st March 2019 for months from July 2017 to December 2018.

Note: From October 2017, the late fee payable by a taxpayer whose tax liability for that month was ‘NIL’ will be Rs. 20/- per day (Rs. 10/- per day each under CGST & SGST Acts) instead of Rs. 200/- per day (Rs. 100/- per day each under CGST & SGST Acts).

Also Check: What is GSTR-2 and How to File it?

Download GSTR-1 Form Formats to File Returns

1, 2 & 3: When filling the form for the first time, the taxpayers are required to mention the aggregate turnover for the preceding financial year and first quarter of the current year in Table 3. In subsequent returns, taxpayers will not have to submit any such information as the aggregate turnover information will auto-populate for subsequent years.

GSTIN is the unique state-wise GST Identification Number allotted to each taxpayer. GSTIN of the particular taxpayer will auto-appear in the box based on the profile of the logged in person. Name of the taxpayer will also auto-populate in the respective field.

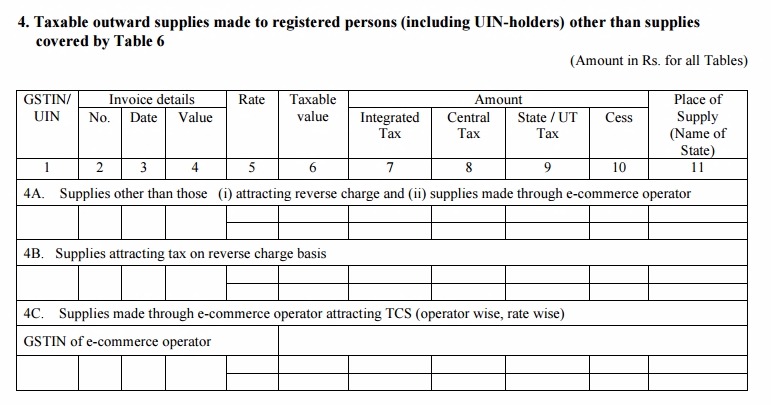

Table 4: Taxable outward supplies made to registered persons (including UIN-holders) other than supplies covered by Table 6: This table will include the information of all B2B supplies (interstate and intrastate) made to registered taxable persons.

Table 4A will include the rate-wise information of supplies of any kind other than reverse charge and the ones made through e-commerce operators.

Table 4B to include rate-wise details of supplies attracting reverse charge

Table 4C to include supplies made through e-commerce operators attracting tax at source (TCS) under section 52 of GST Act.

The Place of Supply (PoS) is required only if it is different from the recipient’s location.

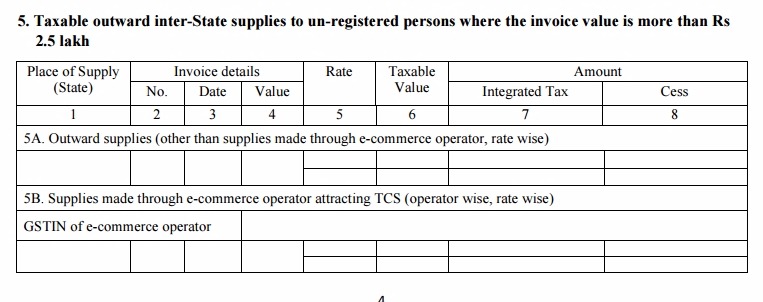

Table 5: Taxable outward inter-state supplies to unregistered persons where the invoice value is more than Rs 2.5 lakh: The table will include the invoice details of all inter-state B2C supplies with invoice value more than Rs. 2,50,000 (Large invoices). It is mandatory to mention PoS in this table.

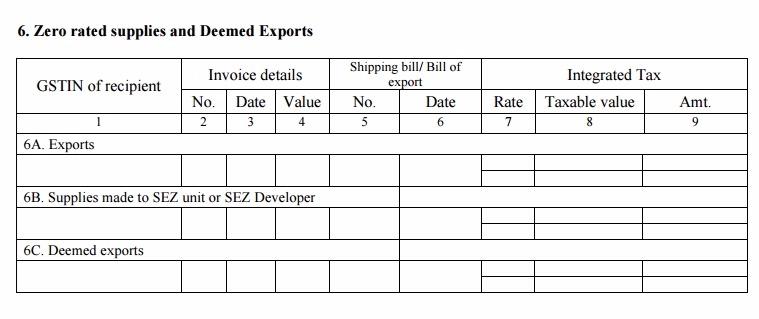

Table 6: Zero-rated supplies and deemed exports: The table will include information about all Exports out of the country, Deemed exports, and supplies to SEZ units and/or developer. Table 6 also needs to have the information about shipping bill and dates. GSTIN will not be entered for export transactions.

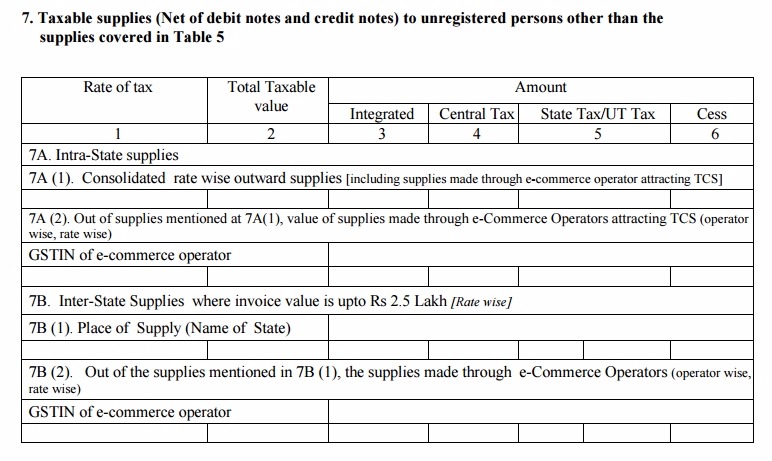

Table 7: Taxable supplies (net of debit notes and credit notes) to unregistered persons other than the supplies covered in Table 5: State-wise supply summaries, rate-wise for all B2C supplies (interstate and intrastate) with invoice value up to Rs. 2,50,000 and made to unregistered persons are to be entered in this table.

Table 7A (1) will include all intrastate supplies (rate-wise) including the ones made through e-commerce portals attracting tax at source. Table 7A (2) will capture only supplies made through e-commerce portals attractive TCS out of total supplies.

Table 7B is similar to Table 7A, except that it will include all interstate supplies (state wise and rate wise).

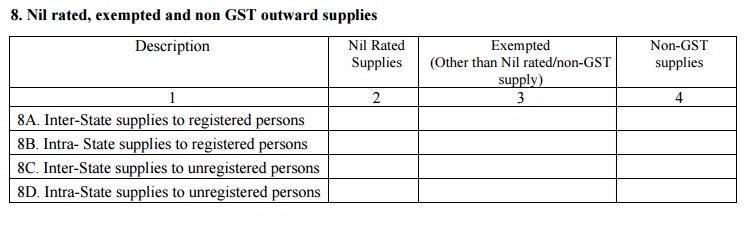

Table 8: Nil-rated, exempt and non-GST outward supplies: All outward supplies (whether non-GST, nil rated or exempt) which are not mentioned in any of the above tables need to be reported here.

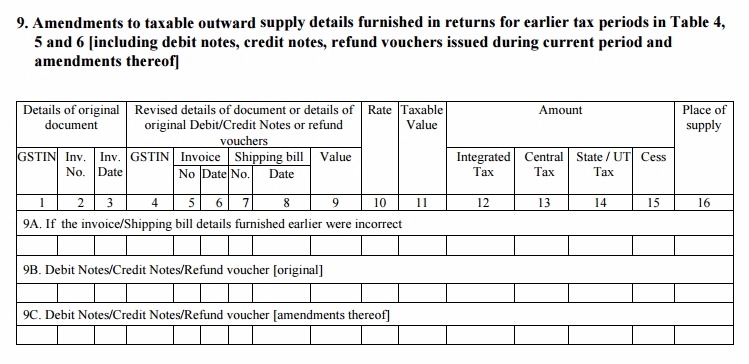

Table 9: Amendments to taxable outward supply details furnished in returns for earlier tax periods in Table 4, 5 and 6 [including debit notes, credit notes, refund vouchers issued during the current period and amendments thereof].

The table will include the rate-wise information of amendments of B2B supplies reported in Table 4, B2C supplies reported in Table 5, and exports/SEZ supplies reported in Table 6. It also includes the information of original credit/ debit notes reported earlier. Place of Supply (PoS) is needed only if it is different from the recipient’s location.

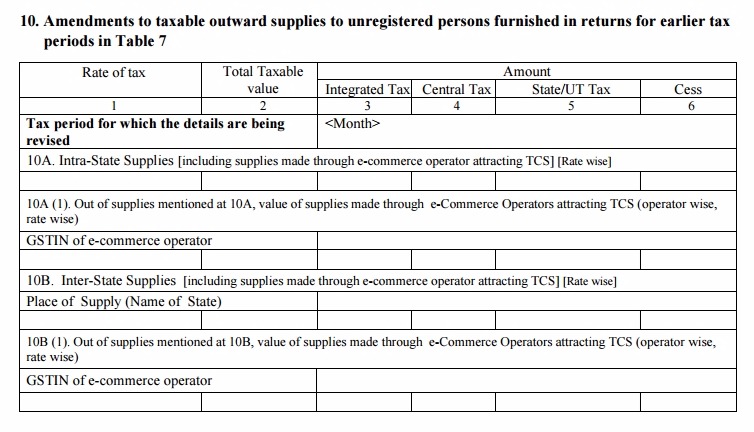

Table 10: Amendments to taxable outward supplies to unregistered persons. Taxable amount net of debit/ credit notes in a tax period and information of taxable outward supplies to unregistered persons from previous tax periods not reported before shall be entered in this table. This may also include negative values.

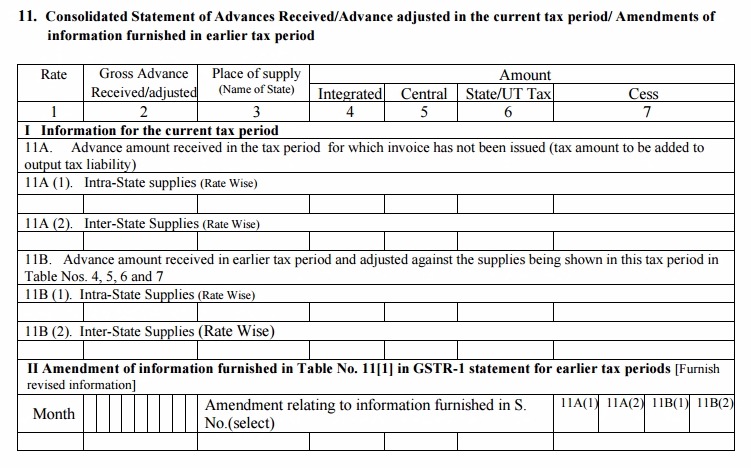

Table 11: Consolidated statement of advances received/advance adjusted in the current tax period/ Amendments of information provided in earlier tax period.

Table 11A includes details of advances received in a particular tax period and tax to be paid.

Table 11B includes information for adjustment of advances received from earlier tax period against current tax period invoices.

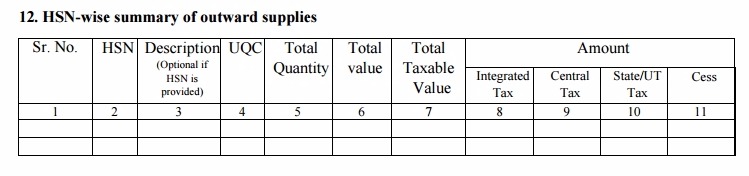

Table 12: HSN-wise summary of outward supplies: The table will contain the information of all supplies against HSN codes. This is optional for businesses with annual turnover less than or equal to Rs. 1.50 crore and they only need to provide descriptions of goods. All other taxpayers are required to enter HSN codes for all their products. This information will decide the IGST, CGST and SGST collected on supplies.

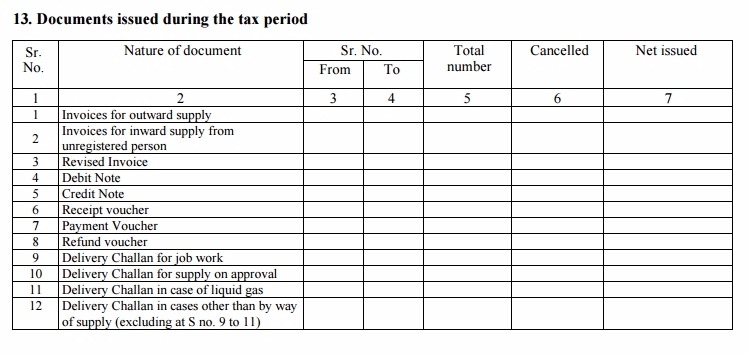

Table 13: Documents issued during the tax period: It contains the list of documents a taxpayer is required to provide when filing GSTR-1.

Here are the important terms for GSTR-1 form:

- GSTIN: Goods and Services Tax Identification Number

- UIN: Unique Identity Number

- UQC: Unit Quantity Code

- HSN: Harmonized System of Nomenclature

- POS: Place of Supply (Respective State)

- B to B: From one registered person to another registered person

- B to C: From registered person to unregistered person

Feel free to ask your GSTR-1 related queries in our free GST Helpline App.